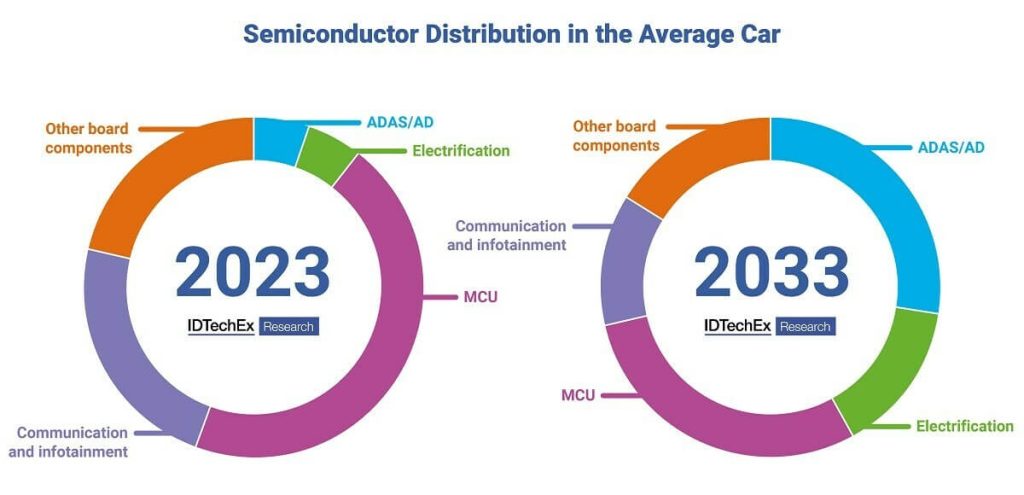

IDTechEx’s research finds that semiconductors for ADAS (advanced driver assistance systems) and autonomy will grow at a 10-year CAGR of 29%. As such, autonomy will be a boon for the automotive semiconductor industry and here are three reasons for that growth.

Automated Vehicles Are Coming

This might even be an understatement. The industry has been guilty of saying that autonomous vehicles are just around the corner for some time, but in some ways, they are already here. Just last month, the Mercedes S-Class got SAE level 3 certification in the US, following its certification in Germany in 2022. This has huge significance as the S-Class tends to be the trendsetter in the automotive industry, and IDTechEx is confident that level 3 technologies will trickle down through vehicle price points over the next decade. Even level 4 vehicles now have an established presence in some cities.

In Phoenix, Arizona, anyone can use Waymo’s completely driverless robotaxis, providing the route and end destination is within select geofenced regions. Autonomous vehicles are not coming; they are here and bring more sensors, more computers, and more semiconductor demand.

More Sensors Using More Advanced Technologies

Not only will autonomous vehicles bring more sensors to vehicles, but they will also require higher-performing sensors with more expensive and more advanced semiconductor technologies. Radar, for example, has previously used quite mature 90nm SiGe BiCMOS technologies, but demand for better performance means that the next generation, 4D imaging radars will be adopting Si CMOS technologies with nodes of 40nm and less. As the node size drops, these radars gain performance, but they will also be gaining cost.

LiDAR has been coming down in price recently, and its adoption is growing. It is a key sensor for vehicles at SAE level 3 and above, but due to the safety benefits it can bring, IDTechEx thinks it will also begin penetrating level 2 and below. Near-infrared LiDARs are the most deployed at the moment, and their detectors can be built on Silicon, making them quite cheap.

But IDTechEx’s “Automotive Semiconductors 2023-2033” report finds that the trend in LiDAR is towards shortwave infrared, which brings performance advantages but requires more expensive InGaAs detectors. IDTechEx sees their increased adoption and transition towards higher value semiconductor types as key drivers in the semiconductor for autonomy and ADAS markets.

High-Performance Computing – Driving Vehicles and Driving the Semiconductor Market

Finally, these highly automated vehicles are going to require high-performance computers capable of thousands of TOPs (tera-operations per second). The chips inside these computers are made using some of the most advanced processes by leading semiconductor foundries like TSMC and Samsung.

This will also impact the automotive semiconductor supply chain; previously, microcontrollers (MCUs) have been the main computers in cars, built on mature technology nodes by established tier 2 suppliers such as Infineon and NXP. But the high-performance computing is beyond their internal fabrication capability, so they outsource to the East Asian giants. But others can do this as well, which is why fabless companies like Mobileye and Nvidia can get more of a stake in the automotive semiconductor market.