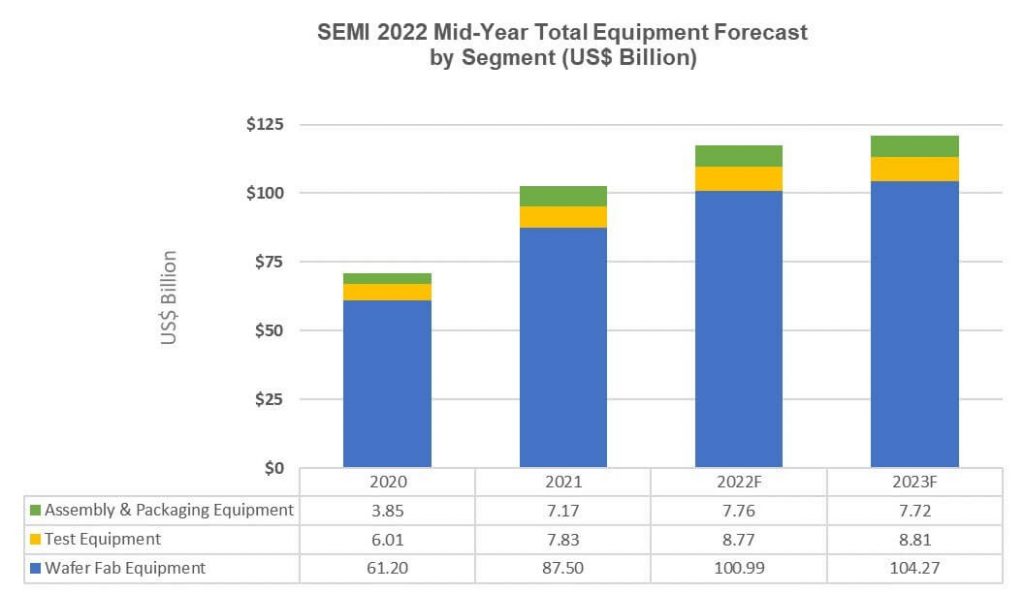

Global sales of total semiconductor manufacturing equipment by original equipment manufacturers are forecast to reach a record $117.5 billion in 2022, rising 14.7% from the previous industry high of $102.5 billion in 2021, and increase to $120.8 billion in 2023.

Both the front-end and back-end semiconductor equipment segments are contributing to the market expansion. The wafer fab equipment segment, which includes wafer processing, fab facilities, and mask/reticle equipment, is projected to expand 15.4% to a new industry record of $101 billion in 2022, followed by a 3.2% increase to $104.3 billion in 2023.

“In line with the semiconductor industry’s determined push to increase and upgrade capacity, the wafer fab equipment segment is poised to reach the $100 billion milestone for the first time in 2022,” said Ajit Manocha, president and CEO of SEMI. “Secular trends across a diverse range of markets, coupled with strong investments in digital infrastructure, are powering another record year.”

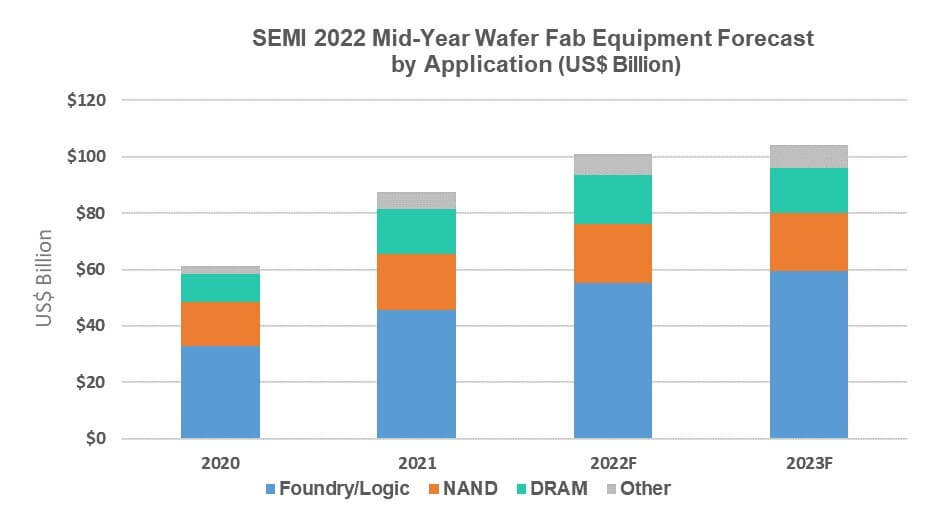

Driven by demand for both leading-edge and mature process nodes, the foundry and logic segments are expected to increase 20.6% year-over-year to $55.2 billion in 2022 and another 7.9%, to $59.5 billion, in 2023. The two segments account for more than half of total wafer fab equipment sales.

Strong demand for memory and storage continues to contribute to DRAM and NAND equipment spending this year. The DRAM equipment segment is leading the expansion in 2022 with expected growth of 8% to $17.1 billion. The NAND equipment market is projected to grow 6.8% to $21.1 billion this year. DRAM and NAND equipment expenditures are expected to slip 7.7% and 2.4%, respectively, in 2023.

After surging 86.5% in 2021, the assembly and packaging equipment segment is expected to grow 8.2% to $7.8 billion in 2022 and edge down 0.5% to $7.7 billion in 2023. The semiconductor test equipment market is forecast to grow 12.1% to $8.8 billion in 2022 and another 0.4% in 2023 on demand for high-performance computing (HPC) applications.

Regionally, Taiwan, China, and Korea are projected to remain the top three equipment buyers in 2022. Taiwan is expected to regain the top position in 2022 and 2023, followed by China and Korea. Equipment spending for other regions tracked, except for Rest of World (ROW), is expected to grow in 2022 and 2023.