Automotive PCB research: vehicle intelligence and electrification bring about demand for PCBs, and local manufacturers come to the fore.

The COVID-19 epidemic in 2020 slashed the global vehicle sales and led to a big shrinkage of the industry scale to USD6,261 million. Yet the gradual epidemic control has driven the sales up a lot. Moreover, the growing penetration of ADAS and new energy vehicles will favor sustained growth in demand for PCBs, which is projected to outstrip USD12 billion in 2026.

As the largest PCB manufacturing base and also the biggest vehicle production base in the world, China demands a great many of PCBs. By one estimate, China’s automotive PCB market was worth up to USD3,501 million in 2020.

Vehicle intelligence pushes up demand for PCBs.

As consumers demand safer, more comfortable, more intelligent automobiles, vehicles tend to be electrified, digitalized and intelligent. ADAS needs many PCB-based components such as sensor, controller and safety system. Vehicle intelligence therefore directly spurs demand for PCBs.

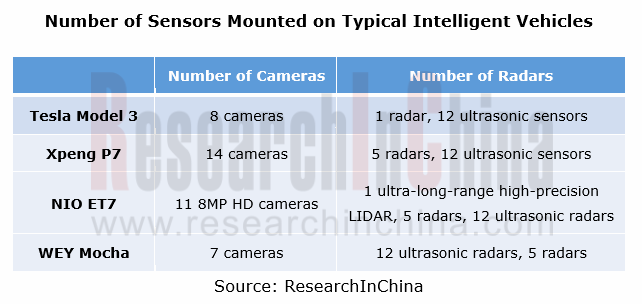

In ADAS sensor’s case, the average intelligent vehicle carries multiple cameras and radars to enable driving assistance functions. An example is Tesla Model 3 which packs 8 cameras, 1 radar and 12 ultrasonic sensors. On one estimate, the PCB for Tesla Model 3 ADAS sensors is valued at RMB536 to RMB1,364, or 21.4% to 54.6% of total PCB value, which makes it clear that vehicle intelligence boost demand for PCBs.

Vehicle electrification stimulates demand for PCBs.

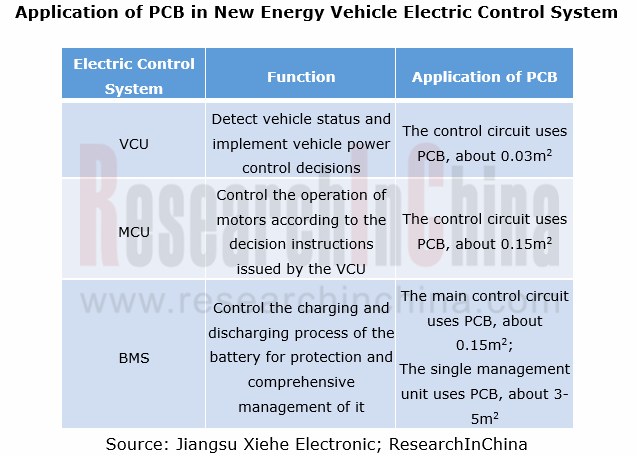

Differing from conventional vehicles, new energy vehicles need PCB-based power systems like inverter, DC-DC, on-board charger, power management system and motor controller, which directly boosts demand for PCBs. Examples include Tesla Model 3, a model with total PCB value higher than RMB2,500, 6.25 times that of ordinary fuel-powered vehicles.

In recent years, the global penetration of new energy vehicles has been on the rise. Major countries have formulated benign new energy vehicle industry policies; mainstream automakers race to launch their development plans for new energy vehicles as well. These moves will be a major contributor to the expansion of new energy vehicles. It is conceivable that the global penetration of new energy vehicles will ramp up in the years to come.

It is predicted that the global new energy vehicle PCB market will be worth RMB38.25 billion in 2026, as new energy vehicles become widespread and the demand from higher levels of vehicle intelligence favors a growth in PCB value per vehicle.

Local vendors cut a figure in the severer market competition.

At present, the global automotive PCB market is dominated by Japanese players such as CMK and Mektron and Taiwan’s players like CHIN POON Industrial and TRIPOD Technology. The same is true of the Chinese automotive PCB market. Most of these players have built production bases in Chinese Mainland.

In Chinese Mainland, local companies take a small share in the automotive PCB market. Yet some of them already make deployments in the market, with increasing revenues from automotive PCBs. Some companies have a customer base covering the world’s leading auto parts suppliers, which means it is easier for them to secure bigger orders to gain strength. In future they may command more of the market.

Capital market helps local players.

In recent two years, automotive PCB companies seek capital support to expand capacity for more competitive edges. With the backing of capital market, local players will become more competitive as a matter of course.

Automotive PCB products head in high-end direction, and local companies make deployments.

At present, automotive PCB products are led by double-layer and multi-layer boards, with relatively low demand for HDI boards and high frequency high speed boards, high value-added PCB products which will be more in demand in future as demand for vehicle communication and interiors increases and electrified, intelligent and connected vehicles develop.

The overcapacity of low-end products and fierce price war make companies less profitable. Some local companies tend to deploy high value-added products for becoming more competitive.