In the view of the China Association of Automobile Manufacturers (CAAM), the biggest impact of the chip shortage on China’s auto industry will be in the second quarter, with a limited impact on annual sales.

“At the moment, the impact of the chip shortage should still be a short-term one, and the impact on sales in the first half of the year should be within 10 percent,” Xu Haidong, deputy chief engineer of the CAAM, said during the 2021 China Automotive Forum.

The chip shortage is expected to ease from the third quarter, especially from the fourth quarter, and it is possible to make up for the loss, he said, adding, “We don’t think it will have an excessive impact on full-year sales.”

During last year’s Covid-19 outbreak, chipmakers were relatively pessimistic about market expectations, leading to limited demand for them to expand capacity, he said.

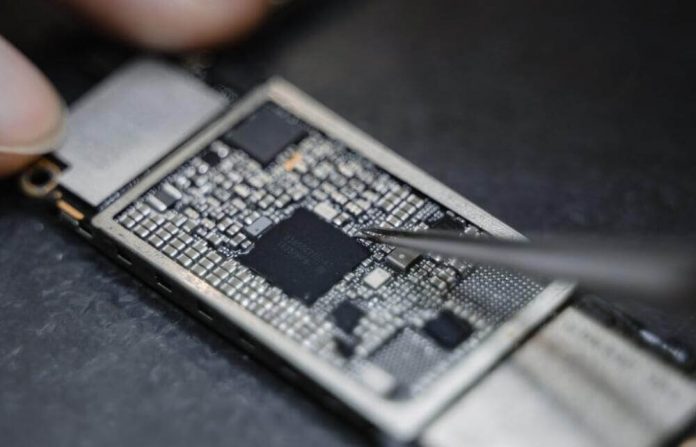

But in fact, the automotive market is recovering very quickly while consumption of consumer electronics is growing. In addition, as the US restrictions on Huawei prompted consumer electronics manufacturers to stockpile in advance, resulting in some production lines for automotive chips being converted to produce consumer electronics chips, he explained.

“Automotive chips have very strict requirements, so production lines producing these chips can be changed to other production lines, but it will take a while to change back,” he said.

Investment in chip capacity will take one to two years to form production capacity, and the industry’s current solution can only be to work overtime to try to make up for chip supply, he said.

Analysts also hold a similar view.

Subject to tight chip supply, the first half of China’s automotive industry demand was not fully released, as chip supply issues improve, the second quarter will see the worst performance of the industry, said CITIC Securities analyst Yin Xinchi’s team in a research report earlier this week.

More specifically, the team believes that May will be the worst time for China’s passenger cars to be affected by supply, as the tight chip supply situation begins to marginally ease from mid-to-late May.

This article was first published by Phate Zhang on CnEVPost, a website focusing on new energy vehicle news from China.