The vast majority of new trucks produced today are powered by diesel engines, but this is expected to change, as with other on-road vehicle sectors. The magnitude of greenhouse gas emission reductions required to reach national targets necessitates a total decarbonization of the truck business over the next 30 years. This will only be possible if zero-emission powertrains are widely deployed. Major truck manufacturers and automotive suppliers have realized this, and the battle for future market share has already begun.

Rapid growth in zero-emission truck sales

Despite increasing interest in zero-emission trucks and substantial recent progress, the global market share of zero-emission trucks in 2022 was around 1.6% of total sales, approximately 39,000 units, with the vast majority in China.

Model availability has grown nearly 65% from 2021 until the end of 2022 (from 182 to 299 models globally). The most robust model-availability growth comes from Heavy-duty truck (HDT) models, which reflect 95% growth from 2021 to 2022 (57 models to 111 models) as the technology advances. Medium-duty truck (MDT) models grew 50% year-on-year between 2021 and 2022. China represents the vast majority of the zero-emission truck market globally – home to approximately 158 models available in 2023. With vehicles now becoming available and production scaling up, IDTechEx expects the global market to grow rapidly at a CAGR of 31% over the next decade.

Electric trucks already deliver useful range

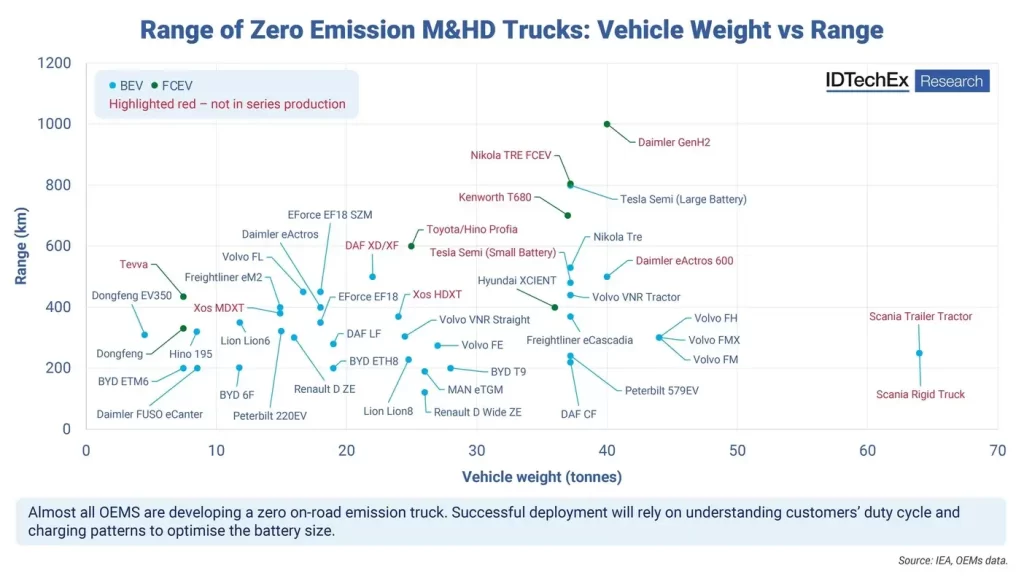

Key to zero-emission truck deployment is understanding daily duty cycle energy demand. It is frequently suggested that electric trucks cannot deliver useful range because the weight and volume of today’s li-ion batteries limit the energy that can be stored onboard a BEV truck. Indeed, the chart highlights that the early generations of BEV trucks are limited to less than 400km on one charge (in optimal conditions). However, while long-haul applications are not yet feasible, a large percentage of urban and regional routes are deliverable with battery electric trucks.

The U.S. Department of Transportation suggests that approximately 73.7% of the weight and 55.4% of the value of goods moved less than 250 miles between origin and destination in 2023, so there is, therefore, a significant share of truck operations that are ripe for electrification. Longer range duty cycles will become possible in the future with improved battery pack energy density, better brake energy recuperation, and charging strategy optimization during breaks in operation.

For BEV trucks to deliver longer-range applications, they will need a large battery capacity, but as such, will require considerable time to charge once depleted. Megawatt class charging is poised to begin commercial rollout and support the quick tup-up of these large batteries in the mandated break times for long-haul trucking operations. The Megawatt Charging Standard (MCS) is designed for a 6-fold higher current and up to 10-fold higher power compared to CCS. Commercialization of chargers with a rated power of 1 MW will require significant investment, as stations with such high-power needs will incur significant costs in both installation and grid upgrades.

Fuel cell trucks to serve a niche

The fact that businesses who have supported MCS, like Daimler Trucks, are now also investing in hydrogen fuelling is perplexing to many. A dual-track strategy is being pursued in the electrification of its portfolio, with both battery-electric and hydrogen-based drivetrains being developed. Fuel cell systems, which generate electricity from pressurized hydrogen stored onboard the truck, offer the possibility of zero-emission long-haul transportation without the need for unfeasibly large batteries and with the ability to refuel in a similar time window to diesel.

The lack of hydrogen refueling infrastructure is a hindrance to FCEV rollout. However, several countries, including Japan, Korea, Germany, and China, are supporting initiatives to build hydrogen refueling stations, which could see FCEV become increasingly operable. A major challenge will also be producing low-carbon hydrogen at a cost that enables it to be a commercially viable ‘green’ automotive fuel. Today, hydrogen is primarily produced from natural gas and has a large carbon footprint.