Price Pressures Persist Despite Anticipated Demand Increase in Q2, Says TrendForce

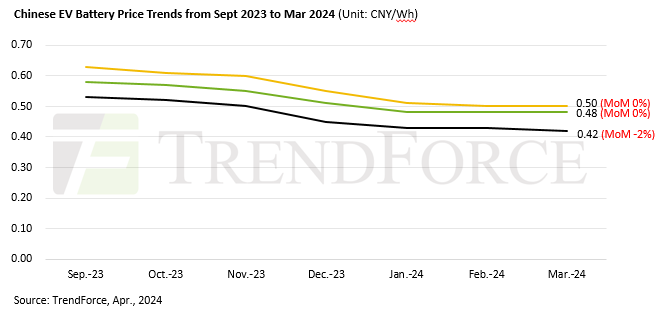

In the wake of a year-long price decline, China’s EV battery market has been witnessing a resurgence of stability since February—buoyed by a united front across the supply chain. TrendForce’s recent analysis highlights a significant rebound in March for battery-grade lithium carbonate prices, surpassing milestones of CNY 100.000 and 110,000/ton before a modest retreat by the month’s end. Nevertheless, the rebound was strong enough to make a 14% increase in average prices for the month. This uptick in raw material costs has provided a solid foundation for EV battery prices in China to hold steady, with notable stability observed across various battery types, including square ternary, square LFP, and pouch-type ternary EV batteries, which posted average prices of CNY 0.48/Wh, 0.42/Wh, and 0.50/Wh, respectively.

For ESS batteries, March sparked the beginning of a recovery in demand, albeit at a pace trailing behind the EV battery sector. While certain companies ramped up production, the broader sentiment remained cautious, highlighted by a 2% dip in the average price of LFP ESS batteries to CNY 0.42/Wh. With the market grappling with an oversupply, the emergence of large-capacity ESS batteries exceeding 280 Ah, known for their competitive pricing, signals a trend toward further price reductions.

Consumer batteries saw a 4% price increase in March to CNY 5.61/Ah thanks to a revival in the prices of key metals like lithium and cobalt. Yet, the potential for further increases in these metal prices appears limited, casting doubts on the sustained recovery of consumer battery prices, with predictions leaning toward stabilization in April.

TrendForce highlights a pivotal shift as we step into 2024; prices for the majority of raw materials have been halved compared to early 2023. As core material costs edge closer to marginal cost levels for businesses, we’re likely to witness an expedited phase-out of higher-cost capacities, paving the way to mitigate overcapacity issues and stabilize supply-demand dynamics. Despite a production cutback on the supply side enabling a halt to the fall and a modest rebound in lithium prices by the end of Q1, persistent overcapacity and a gradual resurgence in demand mean that the supply side can swiftly recover through enhanced capacity utilization, capping the potential for significant lithium price recovery.

Amid this intricate dance of pricing power between upstream suppliers and downstream demand, the forecast for lithium prices in Q2 suggests a limited range for fluctuations. Furthermore, as the EV battery market braces for heightened competition and price wars from Chinese NEV brands introducing a slew of affordably priced EV models, leading suppliers are pushing the envelope, driving battery prices below the CNY 0.4/Wh threshold in a bid to seize greater market share, underscoring a trend toward more pronounced price drops for EV batteries. Consequently, TrendForce projects a slight downtrend in overall battery prices for the second quarter.