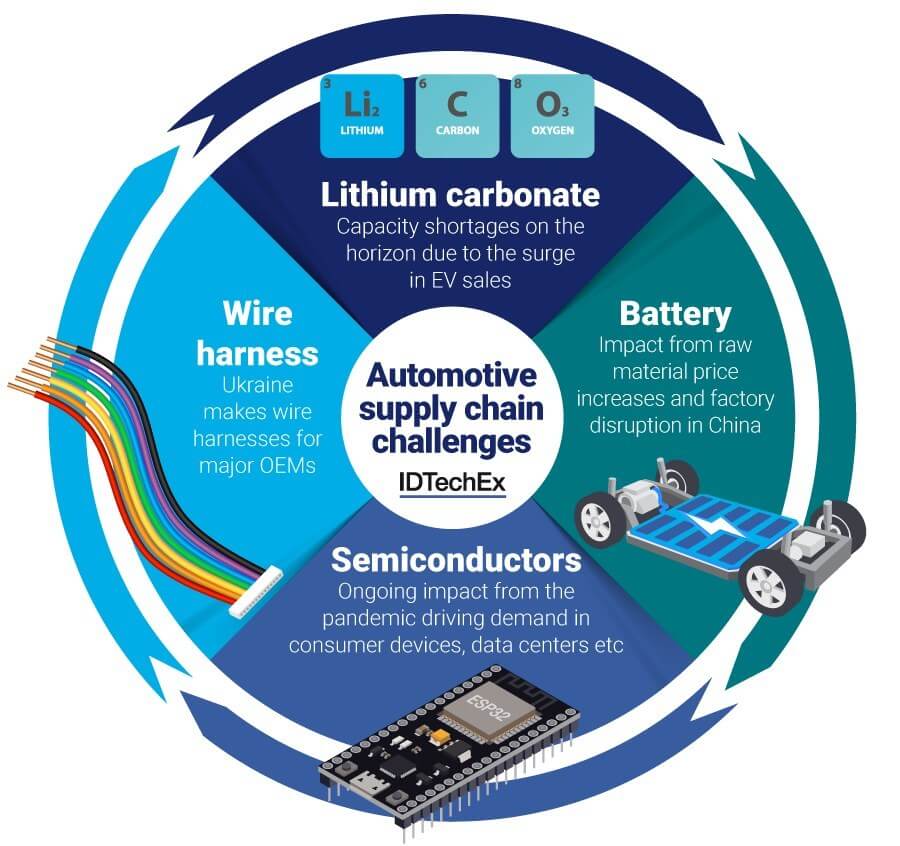

2022 continues to present great challenges for electric vehicle makers. Factory closures in China, driven by the ongoing pandemic, disrupted production (Shanghai, which sells more electric vehicles than Norway, recorded no car sales in April); a wire harness shortage emerged, driven by the war in Ukraine; battery raw material prices increased; chip shortages are lingering; and OEMs have dramatically increased electric vehicle prices.

Despite the challenges, electric vehicle markets have continued to grow in 2022. For example, IDTechEx expects electric car markets to surpass 2021 sales of ~6.4 million, with sales for the first half of the year already reaching 3.5 million (battery-electric and plug-in hybrid).

However, in an era of shortages, disruption is inevitable. IDTechEx believes improvements to drive cycle efficiency and vehicle design, minimizing battery capacity and other material requirements per vehicle, must come to the forefront.

A Transition to > 800V Platforms

Today, most electric vehicles operate at a platform voltage of ~400V. This is a result of legacy: early electric and hybrid vehicle models used this voltage, and the industry conformed around this standard over time. Today, moving beyond 400V typically requires custom designs, which adds upfront cost.

Yet, there is an emerging trend for 800V platforms (and above), with GM, Hyundai, and VW undergoing a transition, following in the footsteps of start-ups such as Lucid Motors.

The key benefit of 800V is it improves efficiency by reducing joule losses and allowing high voltage cabling to be downsized (saving weight). The downside is it requires deep system changes, such as design optimization of the electric motors for the new voltage and a transition towards more expensive silicon carbide MOSFET inverters.

Overall, there is a compelling value proposition for 800V. A 200-mile WLTP car with a 50kWh battery achieving a drive cycle efficiency improvement of 10% (reflecting a transition to an 800V platform, silicon carbide inverters, and lowering the current in the system), improves performance to ~4.4 miles per kWh. The result is a potential battery capacity reduction of 4 -5kWh while achieving the original 200-mile range. At today’s average prices, this would save around $500 – $600 on the battery pack (roughly the total cost of Tesla’s silicon carbide inverter, according to teardown companies).

If this scenario is scaled to 50 million electric cars, ~225GWh of pressure would be removed from the battery supply chain. This is more than the total battery demand IDTechEx expects from off-road electric vehicle sectors by 2043 (construction, marine, and sky taxis).

Optimizing High-voltage Cabling

One of the simplest methods for reducing weight on an electric vehicle (and improving range) is to optimize the high voltage cabling. Both the BMW i3 and the first Tesla Model S used ~20m of high voltage cabling, compared to < 10m in the more modern Tesla Model 3 (IDTechEx estimates), reflecting the potential for design optimization without major technological advancements.

Another approach is changing the conductive core from copper to a lighter material. Aluminum is one such option; its density and conductivity is one-third and 60% that of copper, respectively. While the nominal core area of Al would increase to carry the same electrical current (e.g., approximately 70mm2 of Al wire for 50mm2 of copper wire), there is still a net weight reduction of ~45%, as well as a cost reduction (Al is cheaper and lighter for the same ampacity).

The main example is from Tesla, which reportedly ordered 3000km of Al cable from Gebauer & Griller in 2017. More recent teardown reports from China suggest Tesla uses Al cable on the section between the OBC and external plug in the Model 3, using ~3m of cable.

However, there are challenges. For example, Aluminium connections more readily break over time due to greater expansion sensitivity to temperature, and an insulative Al oxide layer easily forms. Recent developments have looked to mitigate these issues using modern manufacturing and connection processes. While aluminum cabling offers potential, it is not a silver bullet, and its adoption as a standard practice over the next twenty years remains unclear.

Integrated Solar Bodywork

Incorporating photovoltaics (‘solar’) onto the body of an electric vehicle, harvesting energy throughout the day, is another emerging trend that can reduce reliance on batteries. One of the market leaders is Sono Motors, a company that took four years to build what it calls the first ‘Solar Electric Vehicle’, called Sion.

Sion’s flexible polymer-integrated solar bodywork, consisting of 248 panels, can produce up to 21.7 additional miles per day based on an average day in Germany. This would allow a battery capacity reduction of ~4-5kWh, similar to an 800V transition.

As with the other examples given, there are challenges and tradeoffs. A cloudy country, for example, or the potential repair costs in even a minor crash. But the fact that Sono has indicated it can produce Sion at a price point of approximately US$31K is promising.