Automotive OTA research: OTA capabilities determine the success or failure of the transformation of OEMs

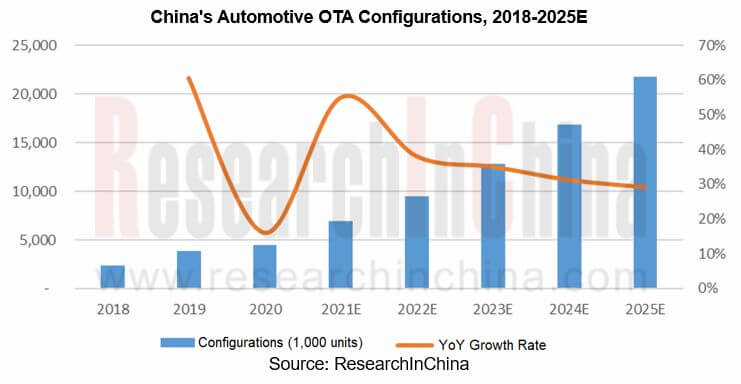

In recent years, automotive OTA configurations have maintained a rapid growth trend. According to ResearchInChina, China’s passenger car OTA OEM configurations will reach 4.449 million units in 2020, a year-on-year increase of 15.9%; the installation rate rose from 19.7% in 2019 to 23.7% in 2020. China’s passenger car OEM OTA installation rate hit 28.3% from January to May 2021, and is estimated at 80% by 2025, and FOTA will gradually dominate.

OTA is a key factor in the closed loop of the software-defined vehicle (SDV) business model.

At present, the supplier model is still the main way for OEMs to deploy OTA. The main suppliers, including PATEO, Banma Information Technology, Harman, Excelfore, Airbiquity, ABUP, CAROTA, Bosch, Continental, Desay SV, Neusoft, Joyson Electronics, etc., can provide complete OTA solutions for OEMs.

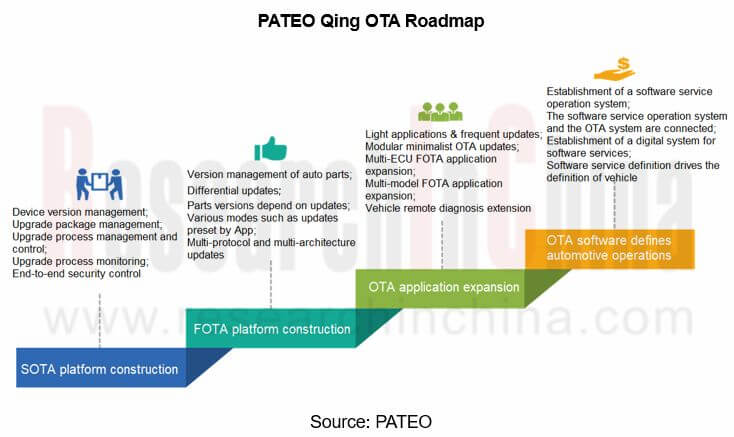

Taking Qing OTA of PATEO as example, PATEO Qing Cloud has established an OTA platform for complex actual conditions. It can not only perform OTA updates for OS, T-Box, applications, maps, etc., but also carry out FOTA updates for clusters, ECUs and other vehicle parts.

As far as the development trend of OTA is concerned, OTA is no longer a single function on cars. From a deeper perspective, OTA will be linked with the development of the entire automotive industry. The development of PATEO Qing OTA starts from the SOTA layout and gradually transfers to the field of FOTA and OTA software operation, and finally reaches the stage where the definition of software services drives the definition of vehicles.

With the maturity and application of automotive software systems and OTA, the business model of the entire automotive industry will also change. From the perspective of consumers, automakers have successively begun to transform their business models, from the past “selling cars” business model to the “selling cars + selling software” business model.

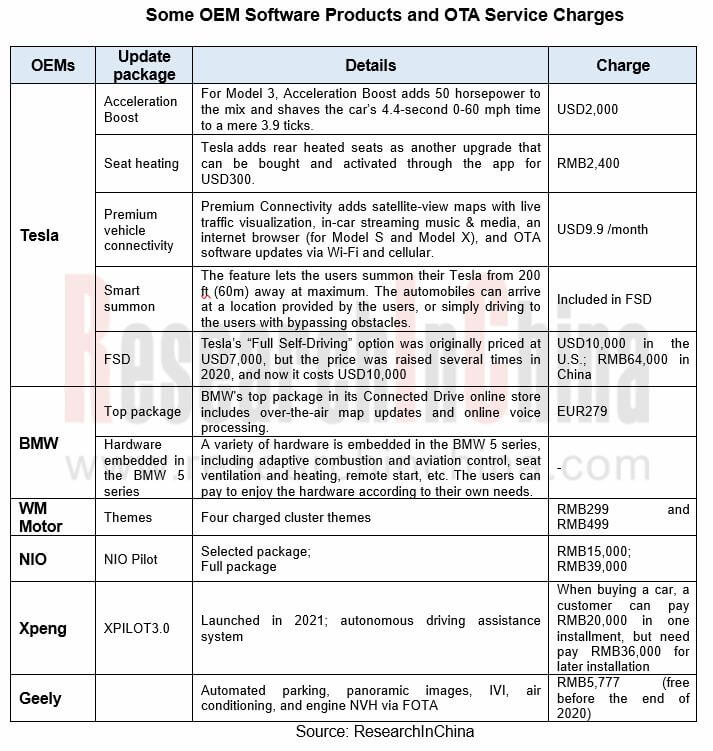

Many automakers have launched paid software packaging and OTA update services. In particular, emerging automakers make faster progress in business models. For example, Tesla provides FSD software package with a price of up to USD10,000. Through embedded hardware and continuous OTA updates, FSD improve the autonomous driving to L3 or even L4. Tesla’s FSD pre-installation rate in the United States is as high as 30-40%. Tesla’s software revenue exceeded USD1.9 billion in 2020, and it is expected to reach USD20 billion by 2025.

Chinese startup Xpeng has launched XPILOT3.0 software package (pre-installed) worth RMB20,000, and NIO has unveiled NIO Pilot (a RMB15,000 selected package and a RMB39,000 full package). Both of them see impressive pre-installation rates and have earned software revenue hereby.

In terms of fuel vehicles, automakers are actively exploring the paid OTA model. In November 2020, Geely PREFACE announced the fuel vehicle OTA update program, which involves hardware and software such as automated parking, panoramic images, IVI, air conditioning, and engine NVH. Via FOTA, the OTA update Solutions is priced at RMB5,777 (free before the end of 2020).

The cooperation between suppliers and OEMs tends to be flexible. There are mainly three OTA cooperation modes: first, turnkey projects, paid software, and end-to-end overall solutions; second, brand new functions, paid project development; third: payment on demand.

Generally speaking, OTA updates after the SOP of vehicles, the improvement of existing functions and patches are supported and maintained by suppliers, and the cost is included into the model development fee without additional charges. If OEMs need to add new features to updates, they need to pay additional development fees to suppliers. OEMs have built their own software development teams to support continuous OTA software updates and enhance vehicle competitiveness.

OTA strategy comparison of Automakers: emerging automakers take the lead, and traditional OEMs are catching up quickly

ResearchInChina found that 31 automotive brands (including emerging automakers, independent brands, and foreign brands) had conducted about 215 OTA updates as of June 2021, 131 of which occurred after 2020. Automakers are accelerating the delivery of OTA updates to customers. Among them, 7 emerging automakers carried out 125 OTA updates, 12 independent brand automakers accomplished 63 OTA updates, and 12 foreign brand automakers performed 27 OTA updates.

Tesla is the earliest automaker that starts OTA updates in the world, and also boasts the most automotive OTA updates in the world. As of June 2021, Tesla had fulfilled 56 OTA updates. Tesla’s first OTA update in China happened in November 2014, with the Version 6.0. It is the first automaker in China that implements OTA services.

The follower Xpeng offered 24 OTA updates. The first update in January 2019 enabled Xpeng G3 to use the Xmart OS 1.1.0, which adds new features (vehicle key summoning, air conditioning ECON mode), as well as optimize full-scenario automated parking, XPILOT 2.5 automated assisted driving, and drivability and charge & discharge performance in extreme low-temperature environments.

In addition to emerging automakers, traditional OEMs such as BYD, Hongqi, Honda, and GAC Aion are speeding up. As of June 2021, BYD enabled about 15 OTA updates for Han, Tang, Song Pro and other models to improve intelligent connectivity, driving assistance system and power.

Since 2020, foreign automakers, including BMW, GM, Ford, Volkswagen and so on, have successively implemented large-scale OTA updates which will be conducted more frequently in the future. In May 2020, BMW began to enable OTA updates for models equipped with the ID.7 system in large scale and batches. As of June 2021, a total of 1.3 million BMW vehicles had achieved OTA updates. The number will be 2.5 million by the end of 2021.

Ford started the first OTA update for SYNC? 4-equipped vehicles in the United States and Europe in March 2021, and plans to make about 1 million Ford and Lincoln vehicles receive OTA updates worldwide by the end of 2021. Ford says it’s prepared to rapidly increase the number of vehicles capable of receiving software updates, with the goal of producing 33 million vehicles with the capability by 2028.

Volkswagen has just announced that it will officially launch OTA updates for its all-electric ID family of vehicles since July 2021. The VW ID.3 equipped with the software version ID.2.1 will be the first model to benefit from the new updates with ID.Software 2.3. Volkswagen’s ID.4, and ID.4 GTX should also see regularly OTA updates. The first update will optimize the lighting functions of the vehicles, and adjust the IVI interface and operation. Volkswagen adds that it will provide updates every 12 weeks.

From the perspective of the update details, SOTA is gradually moving towards FOTA. Although the update is still mainly concentrated in the IVI system (including voice, intelligent assistant, navigation, display, UI themes, entertainment scenarios, etc.), it is gradually spreading to ADAS/autonomous driving, air-conditioning, power system, body & control and so on. According to statistics, as of June 2021, 210 ADAS & autonomous driving functions had been updated, mainly reflected in the opening and optimization of driving assistance functions, such as 32 items related to parking, 18 related to cruise (ACC, ATC, ICA, active cruise, etc.), 19 related to early warning (collision warning, door opening warning, departure warning, etc.), 12 related to surround view, etc.

As OTA supervision enhances, OEMs are facing greater security and compliance challenges

Since 2020, OTA standard policies and supervision have made significant progress. In June 2020, the United Nations Economic Commission for Europe (UNECE) World Forum for the Harmonization of Vehicle Regulations (WP.29) approved the UN Regulation No. 156 – Software Update and Software Update Management System which came into effect in January 2021. This is the first international regulation on vehicle software updates and software update management. To this end, many suppliers have launched OTA compliance-related services.

Regarding supervision, the State Administration for Market Regulation of China issued Notice on Further Strengthening the Supervision over Automotive OTA Technology Recalls on November 23, 2020. In June 2021, it published Supplementary Notice Regarding Automotive OTA Technology Recall Filing to provide a more detailed description of automotive OTA technology recalls.

After the policy was released, Volvo, Mercedes-Benz, BMW and Tesla in China had issued notices of recalling OTA vehicles as of the end of June 2021, and they all stated in their recall announcements that they will upgrade the software for the recalled vehicles free of charge through OTA if conditions permit.