The past two years have been extremely turbulent for many industries with production lines shutting down, chip shortages, and a host of general supply chain issues. Amongst the dismay, electric vehicles (EVs) have been a shining light. In 2021, sales of EVs globally grew by around 80% over 2020 which in turn was a growth of 44% over 2019. So, in the midst of all of these shortages, the demand for EV components has been drastically increasing.

Whilst much news is focused towards the battery pack (and rightly so), the electric motors are equally critical to an EVs operation. EV motors rely on a host of materials including rare earths, copper, aluminum, and steel. These materials have seen sharp rises in price over the past two years and this impacts the margin that a motor manufacturer can obtain. How could motor design changes help with this issue and what steps are already being taken?

Price Increases for Motor Materials

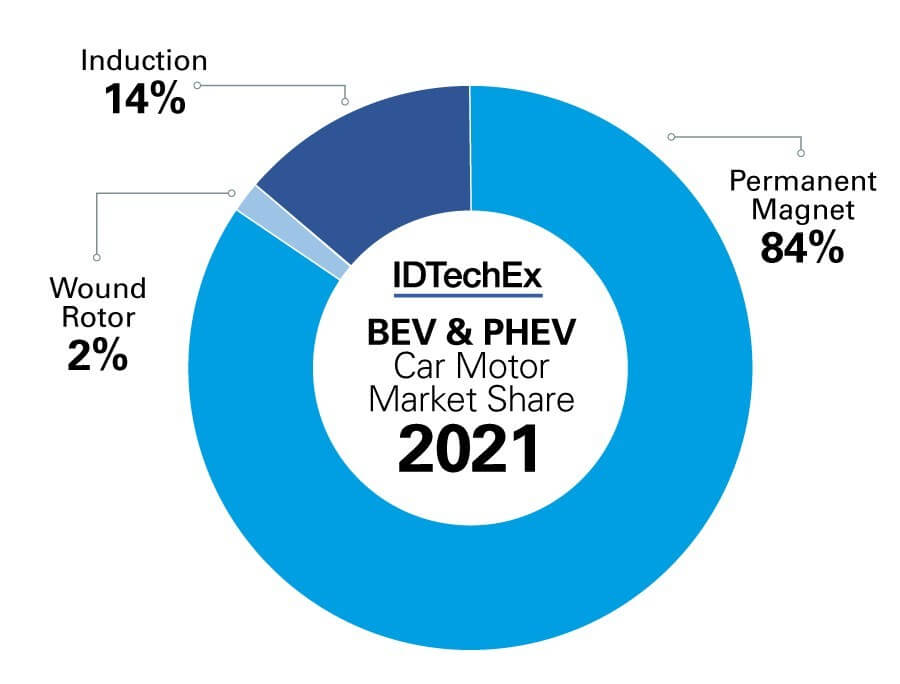

Motors widely used in EVs can largely be categorized into permanent magnet (PM) motors, induction motors, and wound rotor motors. These motors generally use copper wire in the stator (stationary component), the difference is in the rotor (rotating component). PM motors utilize rare earth magnets on the rotor, induction motors utilize copper or aluminum cages or windings, and wound rotor motors utilize copper windings on the rotor.

Each design has inherent pros and cons, but if we just consider the materials, there are some significant differences in cost between designs, this is compounded when we look at the volatility of materials prices over the past two years. The price of neodymium (the main rare earth for magnets) in January of 2022 has increased by over 200% compared to its 2019 value, copper by 59%, aluminum by 62%, and steel by 24%.

This sort of volatility can be a serious issue for motor manufacturers and OEMs. In fact, Japanese motor manufacturer Nidec reported a drop in operating profit in the final quarter of 2021, with one of the stated causes being the increase in copper prices. 5-10 kg of copper are typically used in an EV motor and make up a significant portion of the bill of materials, this varies depending on design, with wound rotor motors utilizing more than the other types.

More drastic price issues can be seen with PM motors where that huge 200% price increase is worsened by the fact that 1-2 kg of magnets are used and the price of neodymium is, on average, 13 times higher than copper. The choice of materials used in an EV motor is critical to the bill of materials and hence the profit margin that can be obtained. Is it worth taking minor performance detriments to change how materials are utilized?

Motor Design Changes

In 2021, 83% of electric motors in EVs were PM motors, a figure which has risen 6% since 2020. Typically they provide the best power density and efficiency and the prices of rare earths have remained fairly stable over the past 10 years (until 2020/2021). A significant reason for the increasing PM motor share has been Tesla’s adoption of a PM motor replacing an induction motor in the Model 3 and subsequent models.

However, due to the high cost and severe price volatility of rare earths in 2011/2012, several manufacturers have opted for alternatives. Audi’s e-tron uses induction motors with aluminum rotor segments and Renault uses a wound rotor design. More recently, BMW’s 5th generation drive system also uses a wound rotor design with copper windings on the rotor.

Whilst wound rotor and induction motors eliminate the reliance on expensive rare-earths, they can increase the reliance on copper, another material that has experienced a significant price increase. A question several have asked is whether the copper in motors can be replaced by aluminum to further reduce costs?

Whilst aluminum is lighter and cheaper than copper, the trouble is that aluminum is less electrically conductive, requiring a greater volume of metal. So, whilst aluminum windings can provide weight and cost savings, they sacrifice volumetric power density. Despite this, we have still seen some players opt for this approach, such as UK-based manufacturer Advanced Electric Machines, which uses a compressed aluminum winding technology to not sacrifice the volumetric performance and avoid the use of any rare earths or copper windings.

Concluding Thoughts

In general, electric motors are a mature technology and most of the cost is down to the bill of materials. As the EV market ramps up and if material prices continue to be volatile, it would not be surprising to see more OEMs and tier 1s adopt magnet free designs in the near future. Thanks to China’s current control of the rare earth supply, they are likely to largely remain with PM motors and hence a very large portion of the global market remaining with that technology. In other regions, it will be interesting to see how the market and designs of electric motors evolve.