Construction machines are estimated to generate around 400 Mt of CO2 emission per year – around 1.1% of global CO2 emission. Decarbonization of non-road mobile machines will therefore be an important factor in efforts to limit global climate change. With an increasing number of countries committing to a net-zero carbon future, the construction industry is facing growing scrutiny of its’ greenhouse gas emissions.

Leading construction machine OEMs and suppliers already recognize that powertrain electrification is set to become a key zero-emission technology for construction machines. Many of the largest engine suppliers such as Cummins, Deutz, and Volvo Penta are investing in electromobility research, and several OEMs have already launched battery-electric construction machines as commercial products, including Volvo CE, JCB, and Komatsu.

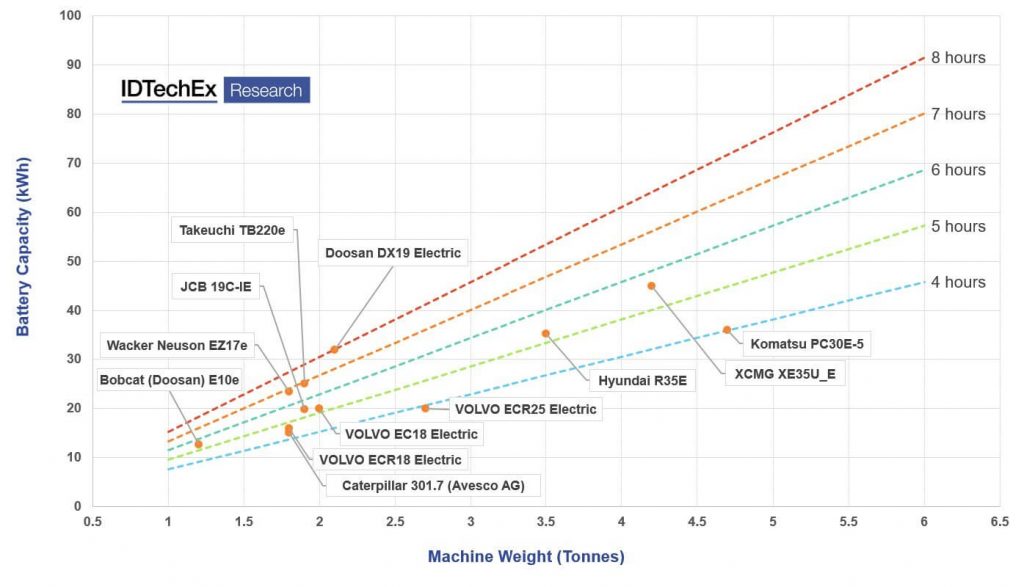

The starting point for most OEMs will be smaller compact machines, whose duty-cycle requirements are relatively light, meaning the daily workday energy and power requirement can be met with a practical size of li-ion battery, electric motors, and a well-defined charging strategy. Indeed, in recognition of the potential for electrification in this segment, Volvo Construction Equipment has already committed to moving its entire range of compact wheel loaders and compact excavators to electric powertrains, completely stopping its development of new diesel models. Other OEMs will follow this lead.

However, as excavators over 10-tonnes are responsible for around 46% of the total CO2 emission by construction vehicles, it is crucial that zero-emission solutions are developed for large machines. The arduous duty cycles of these heavy-duty vehicles mean those over 20-tonnes need more than 300 kWh of energy to deliver a full 8-hour workday. Projects in Norway and the Netherlands have already investigated solutions such as battery swapping and cable operation, to meet the duty cycle demand. In China, construction machine OEMs XCMG, LiuGong, and SINOMACH have all opted for large battery systems with rapid dual-gun DC fast charging (up to 300 kW).

Estimate of Electric Mini Excavator Endurance

Critical to deployment of electric machines will be total cost of ownership. There is a premium on electric machines over diesel, primarily related to the cost of the large battery packs. IDTechEx analysis suggests that the extra cost of an electric mini excavator could be modest enough that diesel fuel savings and reduced maintenance could largely offset the additional premium, but, for larger machines, the extra cost of electrification likely remains prohibitive, and OEMs will need significant regulatory and financial support to promote uptake.

Whilst GHG emission reduction is key, there are other important drivers for machine electrification, most notably health and safety issues around diesel engine operation on construction sites. The UK construction industry is responsible for the largest annual number of occupational cancer cases, with around ~8% of these directly related to diesel engine exhaust emissions. Construction is also a high-risk industry for noise-related ill health. Electric machines are significantly quieter, offering the potential for improved communication, safety, and productivity on-site, whilst reducing the inconvenience of noise pollution for the surrounding area. Elimination of toxic exhaust emissions could improve air quality on job sites and in the surrounding vicinity, greatly improving the work environment for construction workers.

Given the necessity for zero-emission construction machines, IDTechEx forecast that in 2042, the global electric construction machine market will be worth $105 billion (CAGR 25.6%).