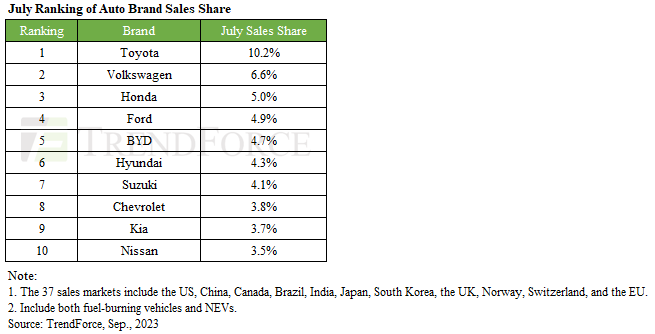

In July 2023, global car sales faced a noticeable downturn, with 5.44 million vehicles rolling off the lot across 37 key markets—a 10% dip compared to June’s figures, according to TrendForce research. However, the top ten car brands managed to tighten their grip on the market, commanding 50.7% of total sales for an increase of 2.3 percentage points from the previous month. This trend indicates a growing concentration of power among leading auto brands.

Leading the pack were Toyota and Volkswagen, clinching the first and second spots respectively for another month. Toyota snagged 10.2% of the global market share. Despite witnessing a 5% sales decline MoM, the automotive giant saw a sales uptick in the US market, buoyed by a replenishment of inventory. Stability prevailed in the Japanese market, while sales in China faltered. Volkswagen’s market share stood at 6.6%, suffering a 13% decline in July, primarily due to lagging sales in Europe and China.

Honda and Ford occupied the third and fourth spots, respectively, experiencing only minor declines in sales and defying the broader market trend. The real headline-grabber, however, was China’s BYD. Not only did it secure the fifth position, but it also stands as the only brand in the top ten focusing exclusively on the NEVs. With its market share and rank surging, BYD, currently a major player primarily in China, has the potential to disrupt the status quo as it broadens its international presence. Making waves at the seventh spot is Suzuki, one of the few brands in the top ten that actually saw a MoM sales increase. Suzuki’s strongholds are India and Japan—both of which saw modest sales gains in July—compensating for a slip in European sales.

TrendForce concludes that the auto market remains susceptible to economic volatility. Challenges like weak domestic demand in China and slow economic recovery in Europe contribute to the sector’s mixed performance. On the flip side, the US is enjoying a sales boom due to an increase in new car inventory, while Brazil’s sales are accelerating, fueled by government incentives. Varying performances across brands can be attributed to their different footholds in these diverse regional markets.