BYD has equipped the Seal with powerful features and offers attractive price tags, making it one of the strongest competitors so far to Tesla’s Model 3 in China.

After months of warm-up, BYD’s (OTCMKTS: BYDDY, HKG: 1211) highly anticipated Seal sedan is finally available for pre-order in China today.

BYD has equipped the Seal with powerful features and offers attractive price tags, making it one of the strongest competitors so far to Tesla’s Model 3 in China.

BYD Seal is available in four versions, with specific post-subsidy pre-sale prices as follows.

- The standard-range rear-wheel-drive Elite version with a range of 550 km starts at RMB 212,800 ($31,860).

- The standard range rear-wheel-drive Premium version with a range of 550 km starts at RMB 225,800.

- The long-range rear-wheel-drive version with a range of 700 km starts at RMB 262,800.

- The four-wheel-drive performance version with 650 km of range starts at RMB 289,800.

For comparison, the Model 3 is currently offered in China in two versions, with the entry version priced at RMB 279,900 and the Performance version priced at RMB 367,900.

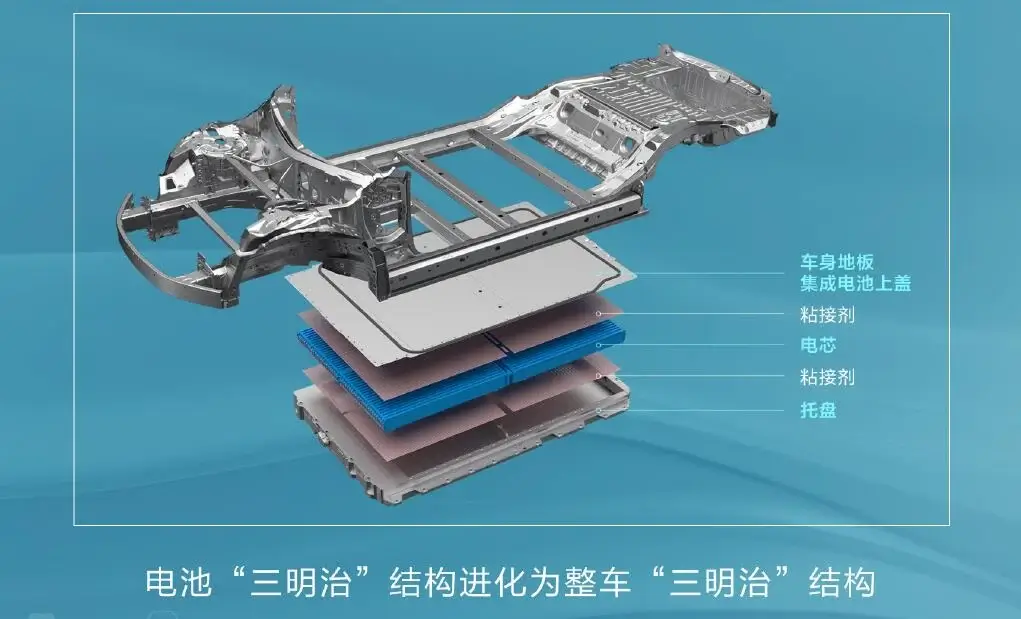

BYD unveiled its technology called CTB (cell to body), which allows the battery to be integrated into the vehicle body, at today’s launch, with Seal becoming the first BYD model to use it.

According to BYD, the CTB solution allows the sandwich structure originally used for the battery pack to be used throughout the vehicle, with the floor of the body integrating the top cover of the battery pack.

This design allows for a 66 percent increase in volume utilization of the battery pack, a 50 percent increase in structural safety in frontal crashes, and a 100 percent increase in body torsional stiffness over conventional designs and more than 40,000 Nm/°, according to BYD.

In terms of safety, CTB technology makes the upper limit of internal combustion engine cars become the lower limit of electric cars, according to BYD.

Seal’s battery pack consists of closely spaced blade cells, top cover and bottom plate in a honeycomb-like sandwich structure, giving the battery system greater strength to withstand the crushing of a 50-ton heavy truck, according to the company.

With CTB technology, the battery is both an energy supply unit and a structural component, thus making it possible for the vehicle to be unbreakable in an accidental crash, according to BYD.

BYD has also introduced on Seal an intelligent torque distribution system it calls iTAC, which enables the vehicle to respond more than 50 ms faster in torque distribution.

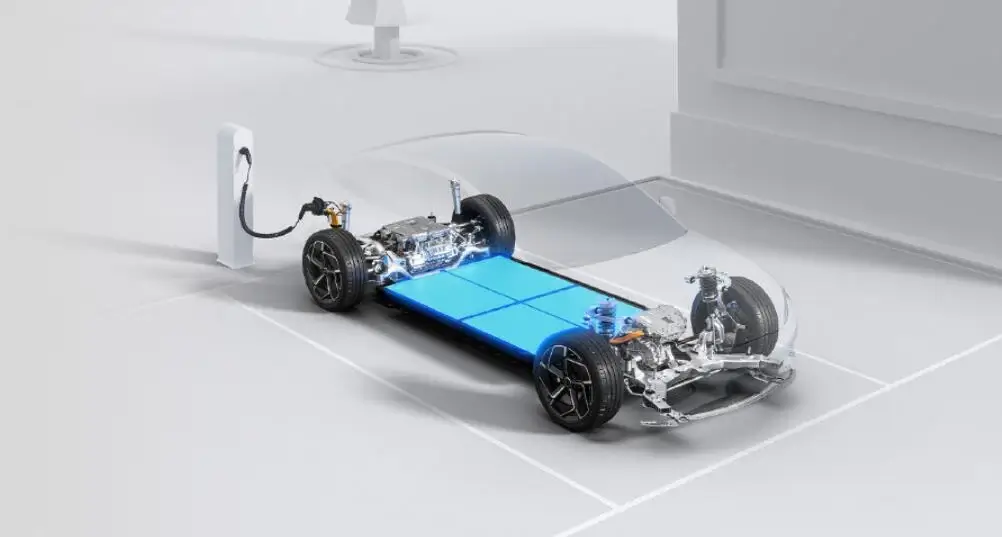

In addition to these new technologies, Seal is built on BYD’s e-platform 3.0, with an eight-in-one electric powertrain, heat pump system, and boost fast charging technology.

The length, width and height of BYD Seal are 4,800 mm, 1,875 mm and 1,460 mm respectively, with a wheelbase of 2,920 mm. As a comparison, the China-made Tesla Model 3 has a length and width of 4,694 mm, 1,850 mm, 1,443 mm, and a wheelbase of 2,875 mm.

The BYD Seal has a wind resistance coefficient of 0.219 Cd, which gives the long-range model a CLTC range of 700 km. The Tesla China-made Model 3 has a CLTC range of 556 km for the entry version and 675 km for the Performance version.

The model’s standard range version supports DC fast charging of 110 kW, and the long-range and 4WD Performance version has DC fast charging of 150 kW, with 30-80 percent fast charging time in less than 30 minutes.

The standard range version of BYD Seal is equipped with a 150-kW rear motor, and the long-range version is equipped with a 230-kW rear motor. Its 4WD performance version has a total front and rear motor of 390 kW and accelerates from 0-100 km/h in 3.8 seconds.

BYD has not announced when deliveries of the model will begin, but months of waiting are to be expected.

At the end of March, local media Cailian reported, citing the company’s investor meeting minutes, that BYD’s cumulative undelivered vehicle orders reached 400,000 and were still increasing month by month.

BYD expects China’s new energy vehicle (NEV) penetration rate to exceed 35 percent this year, possibly reaching 40 percent.

In a conservative scenario, BYD expects it to sell 1.5 million vehicles in 2022, and if supply chain conditions improve, sales are expected to reach 2 million vehicles, according to the minutes.

BYD bucked the trend and became an exception as sales of Chinese car companies generally plunged in April.

The company sold 106,042 NEVs in April, up 1 percent from March and up 313 percent from a year earlier.

This is the second consecutive month that BYD has sold more than 100,000 NEVs, another record high, after selling 104,878 units in March. It discontinued the production and sales of internal combustion engine vehicles from March.

This article was first published by Phate Zhang on CnEVPost, a website focusing on new energy vehicle news from China.