New Energy Vehicles (NEVs) that are currently on the market are mostly powered by lithium batteries. Accounting for more than one third of the cost of the entire vehicle, the power battery is the core factor that dictates a vehicle’s performance.

Due to the rising energy density bar for subsidies for power batteries and consumer preference for long-range vehicles, the superior-energy-density ternary lithium battery is the current market leader and is being installed in more and more vehicles from year to year.

Besides the ternary lithium battery, the lithium iron phosphate battery, the lithium-ion battery, the lithium manganese oxide battery and the multi-element composite lithium battery also have significant market share. In terms of trends, all power battery companies are trying to enhance battery energy density by improving material systems and light-weighting.

With that in mind, auto original equipment manufacturers (OEMs) are accelerating the deployment of their power battery businesses. In 2017, Toyota and Panasonic established a joint venture called Prime Earth EV Energy, focusing on prismatic batteries for hybrid vehicles. In 2019, the two parties joined forces again to set up a vehicle battery joint venture that would seem them working together to develop and produce high-capacity batteries for Electric Vehicles (EVs), and mass produce them by 2025.

In 2019, Toyota also established formal partnerships with CATL and BYD in an open cooperation in the field of pure electricity. The partnerships will not just be limited to the supply of power batteries, but will also cover battery recycling and the development of pure EVs.

In 2020, in collaboration with scientists from Kyoto University, Toyota developed a new fluorine ion battery, with energy per unit weight approximately seven times that of a traditional lithium-ion battery, and one charge delivering a range of 1000km. According to Japanese media reports, this joint team has successfully developed a rechargeable prototype of the battery using solid electrolytes, with the cathode made of fluorine, copper and cobalt and the anode made mainly of lanthanum.

In 2019, Volkswagen also invested in a lithium battery company called Northvolt to mark its entry into the power battery business. The Volkswagen Group plans to invest 900 million euros in battery R&D in collaboration with Northvolt for the mass production of batteries. Northvolt benefits from strong investment endorsement from government agencies and large-scale enterprises, having received more than 1.4 billion euros to date.

Volkswagen’s heavy investment in Northvolt is related to the global manufacturing footprint of high-end power batteries. Currently, the main high-end battery technology is owned by a handful of companies including Panasonic, CATL, Samsung SDI, LG Chem and SKI. In order to control such a core part as power battery and to ensure supply chain security, auto companies are driven towards extensive investment and collaboration with power battery companies.

Tesla is no exception. In 2019, it announced the acquisition of supercapacitor maker Maxwell at a 55% premium, for 218 million US dollars. By absorbing external technical teams to focus on deploying in battery technology in the future, Tesla is also further ramping up coordinated development with energy storage business and solar technology. Maxwell’s high-energy, high-density batteries and its engineering design for battery pack and chassis will help Tesla achieve even lower energy consumption and longer driving range for its products.

Breakthroughs in battery technology are a hot topic for carmakers. In 2020, GAC Group announced it was continuing research into the graphene battery, saying it expected to pilot mass production for real vehicles by the end of this year. Whether mass production can happen eventually will be determined by the test results.

The graphene battery developed by GAC can reportedly be charged with 80% full power within eight minutes, implying that a 10-minute charge can translate into driving range of 200-300kms. This charging speed is comparable to gas refueling. GAC is currently running preliminary tests for the graphene technology on multiple levels including battery cells, modules and installation on vehicles. Based on previous plans, the graphene super-fast charging battery will be mass produced and installed on the Aion series of vehicles.

Independent domestic brands are also fully deploying the power battery industrial chain. Take GWM for example. SVOLT was set up to help GWM resolve issues such as scarcity of high-end power battery cell production capacity. Outside China, SVOLT has invested a total of 2 billion euros to build factories in Europe with a total production capacity of 24GWh. It has also announced the establishment of a module PACK factory and a battery cell module factory in Saarland, Germany. The former will be in production as early as the second quarter of 2022 and the latter at the end of 2023.

In terms of more cutting-edge battery technology reserves and development, SVOLT leverages the Wuxi 118 Global Lithium Battery Innovation Center as its platform, and is exploring new lithium technology for the next decade through preliminary development of technology and products including all solid-state battery, capsule battery, self-gassing battery and hybrid cathode materials.

Mathew Effect in the continuous breakthroughs in battery technology

Judging by the intensity of investment from major manufacturers, this arms race in terms of battery technology is far from over. For one, cost is one of the most important considerations for power batteries. Costs have been dropping thanks to years of technological development, with battery prices currently one fifth of what they were ten years ago, and the cost of battery as a percentage of whole vehicle cost dropping from 60% from five years ago to 30%-40%. Still, since price parity is the most important factor restricting the deeper penetration of EVs, battery cost still relies on continuous breakthroughs in materials, scale and technology.

For instance, finding low-cost material systems, reducing the use of parts, and developing batteries that do not use precious metals or use metals at all is essential. Cobalt is a rare earth metal that is indispensable to the positive electrode of ternary lithium material, and the demand for it will keep rising with the rapid development of NEVs.

The earth’s cobalt content, however, is relatively low. Limited cobalt resources dictate high prices of the metal, and supply might fall short of demand in the future. Confirmed terrestrial cobalt resources worldwide are 25 million tons and reserves 7.2 million tons. Global cobalt resources are actually very unevenly distributed, with cobalt reserves highly concentrated in Congo (DRC), Australia and Cuba. To be more specific, the combined cobalt reserves of those three countries account for 68% of total global reserves.

Being cobalt-free is one of the common goals in the research and development of power battery material systems. In 2020, an executive from CATL revealed that the company is developing a new type of EV battery that does not contain nickel or cobalt. Nickel and cobalt are key components of the battery that powers EVs. Many battery manufacturers including Panasonic in Japan and LG Chem in South Korea are reducing the amount of the expensive cobalt used in NCA or NCM batteries. Moreover, CATL is developing a separate technology to directly integrate batteries into the frame of an EV so as to increase its driving range.

In May 2020, SVOLT, a battery company under GWM, debuted the NMx cobalt-free battery it had developed. Through the cation doping technology, single crystal technology and nano-networked packaging, this battery has significantly improved nickel-lithium ion mixing and cycle life in the absence of cobalt, suggesting the possibility for cobalt-free materials to overcome these key obstacles and reach the stage of large-scale applications.

Besides rare metals, battery materials are one of the focuses for the major manufacturers in their business deployment. Currently, cathode materials used for lithium power batteries in NEVs include ternary materials, lithium iron phosphate, lithium manganese oxide and lithium cobalt oxide.

CATL, for example, has chosen to focus its investment on the production of cathode materials and lithium resources required for the production of cathode materials. In September 2019, it announced the plan to purchase 8.5% of the shares of Pilbara which is a lithium mining company in Australia. And in April of the same year, it announced that its subsidiary CATL Bangpu would invest in the construction of production capacity of 100,000 tons/year of nickel cobalt lithium manganese oxide cathode materials.

In the raw material supply chain, the competition to integrate upstream resources is particularly fierce. Take Gotion High-Tech for example. Since its establishment in 2006, this power battery company has dedicated itself to the independent development, production and sales of lithium power batteries for NEVs. In 2019, the company’s power battery installation volume was 3.2GWh which translated into a domestic market share of 5.2%, ranking third in the country, after CATL and BYD. Of the 3.2GWh, lithium iron phosphate batteries accounted for 2.9GWh, ranking second in the country.

As of now, Gotion High-Tech has deployed batteries in nickel, cobalt and lithium resources as well as the four major raw materials for batteries (cathode materials, anode materials, separator and electrolyte) to further enhance its own cost advantage. Its subsidiary Gotion Precision Coating Materials Co., Ltd. has started mass producing carbon-coated aluminum foil, and is collaborating with MCC to develop ternary precursor materials and with Tongling Nonferrous Metals Group Holdings Co., Ltd. to develop copper foil, and co-investing with Shenzhen Senior Material Technology Co., Ltd. in separator development and with Shanghai Electric to enter the energy storage field.

In terms of clients, Gotion High-Tech has established strategic partnerships with a large number of outstanding domestic vehicle companies including BAIC, SAIC, JAC, Chery, Changan, Geely and Yutong. At the same time, the company is accelerating its internationalization. It has entered the Bosch global supply chain system and set up a joint venture with Tata in India to develop the Indian lithium battery market. On May 28th, 2020, Gotion High-Tech announced the plan by Volkswagen China to make strategic investment in the company.

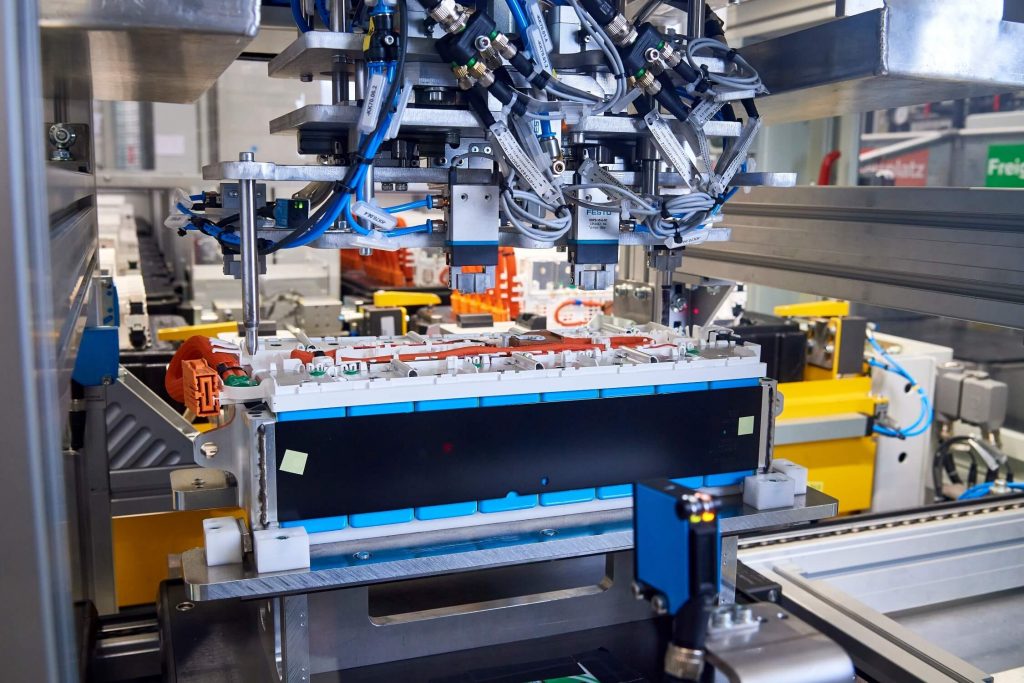

Competition on the technical level is even more complicated, and there were times when multiple technical routes were taken. Take battery packaging for example. It is one of the key technologies that affect battery safety and life. Based on market analysis reports, since power battery products are used in different scenarios, impact resistance, vibration resistance and resistance against mechanic shocks such as squeezing and puncturing are one of the requirements for battery packaging. In addition, battery packaging needs to meet chemical requirements such as fire retardant requirement and immersion requirement, and to meet lightweight and wiring requirements in terms of design. Therefore, power battery packaging does have a certain technical threshold.

Power battery research has shown that at present, based on the sub-assembly technology, power batteries can be divided into three types, namely, prismatic battery, cylindrical battery and soft pack battery. And each has its advantages and disadvantages.

1) A prismatic battery, as the name suggests, refers to a single battery made into a prismatic shape. Compared against cylindrical packaging, the prismatic shape narrows the gap between cells and allows internal materials to be rolled more tightly. As a result, the battery will not easily expand when restricted by high hardness, which is relatively safe. Moreover, the shell is made of aluminum-magnesium alloy which is lower in density, lighter in weight and higher in strength, thus enhancing the battery’s energy density and safety and range.

2) Both cylindrical batteries and prismatic batteries come in hard shells, but the cylindrical packaging distinguishes itself with its small size, flexible grouping, low cost and mature techniques. At present, the Panasonic batteries used in Tesla’s pure EVs are hard-shell cylindrical batteries. In later stages, however, the cylindrical battery will face issues such as difficult post-grouping heat dissipation design and low energy density.

3) Although the soft pack battery has advantages such as flexible size change, high energy density, light weight and low internal resistance, it also has disadvantages such as poor mechanical strength, difficult sealing process, complex grouping structure and difficult design. Even in cost, consistency and safety, it is of average performance.

At present, prismatic packaging is the most common battery packaging in China. Of the three different shapes of battery, namely, prismatic, cylindrical and soft pack, prismatic batteries still dominate the market and are the only technical route maintaining an YOY increase in 2019. In 2019, the installation volume of prismatic batteries was 52.73GWh, which was a YOY increase of 24.8% and accounted for 84.5% of the total installation volume.

The three companies with top installation volumes are CATL, BYD and Gotion High-Tech. An oligopoly effect has been formed in this field, and studies suggest that the leading position of prismatic batteries will not change in the short run.

Furthermore, most major technological breakthroughs are accredited to leading companies. Take the efficiency of battery packs for example. In a traditional battery system, the costs of the battery’s internal structural parts and packs are relatively high. Non-modular technology is expected to improve battery pack design, enhance battery pack efficiency, and optimize layout, structure, topology and low-density materials, thereby reducing costs.

In September 2019, CATL launched the CTP technology at the Frankfurt Motor Show. With the CTP technology, the volume utilization rate of battery packs can be improved by 15%-20%, the number of battery pack parts reduced by 40%, and the energy density of battery packs increased by 10%-15% to above 200Wh/kg. At the same time, the number of intermediate links can be minimized, production efficiency improved by 50% and production cost of power batteries dramatically reduced.

In March 2020, BYD introduced its new-generation blade battery. With increased length, the battery cells are flattened. And with the densely arrayed cells acting as structural parts themselves, sufficient strength is maintained to provide support, thus eliminating part of the traditional battery pack’s protective structure and improving the space utilization rate inside the battery pack shell from 40% of the tradition design to 60%. At the same time, the new blade battery features further improvements in battery life, range, safety performance and grouping efficiency, and its cost has been reduced by 20%-30%.

More technological breakthroughs are likely on the horizon, and solid-state battery technology, for one, is widely touted to be the next-generation power battery technology as the number of related patents has increased by more than tenfold over the past decade. But the power battery industry overall features high barriers to entry due to factors including large-scale investment required by the industry, long R&D input-output cycles and technical barriers. With time, competition among power battery companies will become more heated, and an industry reshuffle will be accelerated. The future will be exciting to behold.