The shortage of automotive MCUs will continue, and how OEMs can break the situation.

Although the panic about the severe lack of automotive chips has come to an end, the boom of new energy vehicles has led to tight supply of some automotive MCUs, especially high-end 32-bit MCUs which will be still undersupplied in 2023.

At present, automotive chip IDMs outsource about 15% of their products, mainly MCUs. Despite being IDMs, NXP, Infineon, Renesas and the like still adopt a foundry model in MCU production. For example, NXP which has built its own fabs still outsources 90nm and above products such as i.MXRT1170, a 28nm high specification MCU that needs to be fabricated by a foundry.

In terms of foundries, TSMC manufactures about 70% of automotive MCU products, and is also working to expand its 28nm mature process capacity in Nanjing of China and Japan. All major vendors are trying hard to expand their capacity. Yet from the capacity expansion plans of TSMC and major MCU vendors, it can be seen that a still limited amount of new MCU capacity of major IDMs and wafer foundries will be released in the short term.

The shortage and higher price of automotive MCU not only push up the cost of OEMs but bring about reduced vehicle production. OEMs therefore hope to establish a safer chip supply chain system.

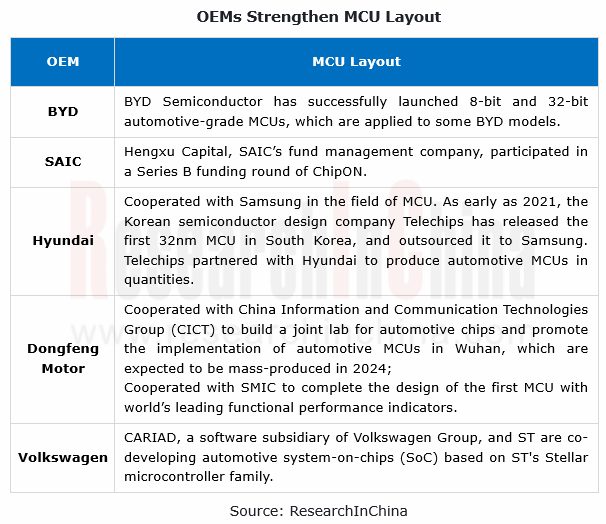

OEMs seek tight bonds with MCU vendors to achieve chip standardization and supply chain safety.

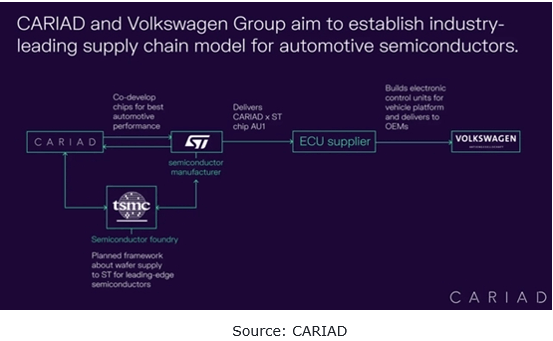

Volkswagen: in July 2022, Volkswagen’s software company CARIAD forged a tight bond with STMicroelectronics (ST) to jointly develop automotive chips, which will be fabricated by the wafer foundry TSMC. The customized chips will be expanded on the basis of ST’s Stellar MCU family architecture. In the future, all the Tier 1 suppliers of Volkswagen Group will only use the chips co-developed by both companies (AU1 family), or ST’s Stellar family standard MCUs.

Chinese MCUs take the fast lane.

SAIC: specify its strategy for localization of high computing power chips and MCUs. In 2022, SAIC-GM-Wuling adopted the KF32A Series automotive MCU (model number: KF32A150MQV) produced by ChipON.

Dongfeng Motor: in 2021, Dongfeng Motor and the CICT established a strategic partnership on automotive MCUs, aiming to jointly build a joint lab for automotive chips and facilitate the layout and implementation of automotive MCUs in Wuhan. In addition, in cooperation with SMIC, Dongfeng Motor also completed the design of the first MCU with world’s leading functional performance indicators.

At present, in the aspect of localization, Chinese automotive MCU vendors start with the body domain that poses low requirements for product performance, having replaced a certain number of foreign products.

Body control: BYD Semiconductor, ChipON and Sine Microelectronics among others have already achieved mass production for OEMs in basic body control, and some vendors which enable fully localized production boast certain price advantages.

Intelligent cockpit: Tier 1 suppliers have started supply of MCUs for cockpit entertainment. Currently AutoChips and Huada Semiconductor are able to match their foreign counterparts.

AD/ADAS: homemade MCUs have less chance of making their way into this field in the short term, but Semidrive Semiconductor, ChipON Microelectronics and GigaDevice Semiconductor have made product plans.

Power/chassis: there is temporarily no domestic product in this field, leaving more scope for players with related products to overtake on the bend.

Automotive MCU technology trends: multi-core and high frequency, high security, new storage, process upgrade.

Automotive MCUs are led by 8-bit, 16-bit and 32-bit ones. As vehicles tend to be intelligent, 32-bit MCUs are widely used and dominate the automotive MCU market. The new-generation MCUs need to have the capability of safe processing, or redundant decision. In terms of MCU technology evolution, high performance, intelligence and high integration have become the development trends.

Multi-core and high-frequency: suppliers often use cores with multiple main high frequencies to improve the computing and processing power and security level of MCUs.

The single-core or dual-core architecture of most automotive MCUs features main frequency of about 100MHz, and high-performance products can reach 300MHz. In recent years, suppliers have rolled out multi-core, lock-step products, with the main frequency of a single core even up to 800MHz-1GHz, greatly enhancing the performance of MCUs.

Among them, the lock-step architecture can offer far higher security, that is, equip the main core with a shadow core, both cores execute the same instructions simultaneously, and then a comparator is used to find the differences. If either of the cores fails, the comparator will take a corrective action. For example, NXP wants to use lock-step architecture to reach ASIL-D performance requirements based on its existing ASIL-B products.

MCU products themselves don’t require advanced process, and generally use 8-inch wafers and 40nm and above process. Now to better cope with the power consumption problem caused by main high frequency, automotive MCU vendors begin to use more advanced chip fabrication process and gradually migrate to 12-inch platforms, using 28nm or even 22nm process.

NXP: the S32K39 series of automotive MCUs, launched in November 2022, is optimized for electric vehicle (EV) control applications and outperforms conventional automotive MCUs in networking, information security and functional safety, making itself the best performer in the S32K series.

S32K39 is equipped with four Arm? Cortex?-M7 cores at 320 MHz configured as a lockstep pair and two split-lock cores, packs two motor control coprocessors and NanoEdge? high-resolution pulse-width modulation (PWM) for higher performance and precision control, and integrates DSP for flexible digital filtering and machine learning (ML) algorithms.

Semidrive Semiconductor: the E3 MCU family mass-produced in October 2022 is divided into five series: E3600, E3400, E3200, E3300, and E3100. Among them, the highly integrated E3100 Series with low power consumption is designed for BCM, gateway, T-Box, IVI, etc.; E3300 Series is a display MCU integrating high-performance image processing engine for cockpit display; E3600/E3400/E3200 Series are used in high-safety fields such as BMS, brake, chassis and ADAS.

The E3 family covers single-core, dual-core, quad-core and hexa-core versions, with main frequencies ranging from 300MHz, 400MHz and 600MHz to 800MHz. Thereof, the high-performance version has six built-in ARM Cortex-R5F cores with main frequencies up to 800MHz, four of which can also be configured as two lockstep pairs or split cores, with the functional safety level up to ASIL-D. It is known that about 20 automakers and Tier1s have started application development based on the E3 family MCUs.

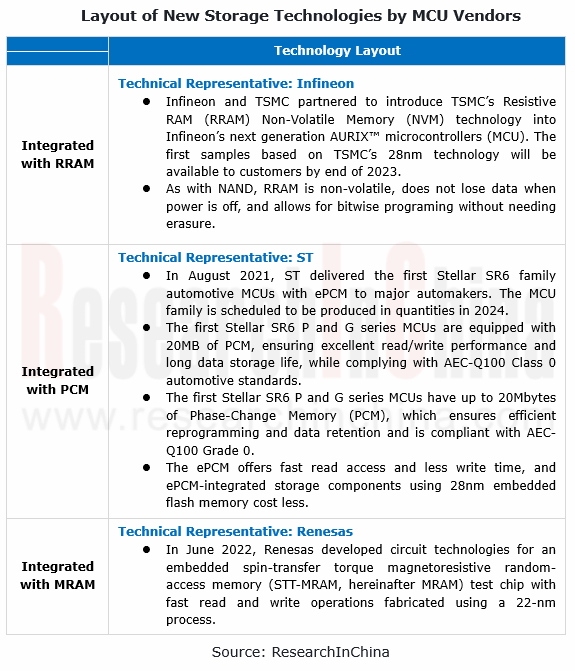

MCU introduces new storage technology.

MCUs mainly use embedded flash memory. As MCU performance is improved flash memory can be erased and programed for very few times, making it unsuitable for data storage. Flash memory can no longer meet the needs of automotive MCUs. So automotive MCU vendors have set about laying out new storage technologies such as resistive random access memory (RRAM), phase change memory (PCM) and magnetoresistive random access memory (MRAM).

Application trends of MCU in the E/E architecture upgrading trend

Currently, automotive E/E architecture is developing from distributed architecture to domain controller architecture in which some ECUs will be replaced and MCUs will be reduced accordingly. In addition, in the domain controller architecture, some MCUs will be replaced by high computing power SoCs and become a “SoC+MCU” control chip pattern. Therefore, from the perspective of the whole vehicle, the usage of MCUs per vehicle will decline later, and the MCUs used will have higher requirements for functional safety.

(1) SoC+MCU combination in domain centralized architecture

The development of intelligent cockpits favors the installation of streaming media rearview mirrors, HUDs and integrated displays, which require higher computing power cockpit chips. Hence main control chips used are generally SoCs running on complex operating systems for big data processing. And the MCU is often used to access the body network for CAN/LIN bus wake-up, communication and power management. Moreover, the MCU also manages power supply for SoCs and monitors its state.

The hardware architectures of intelligent driving domain control and cockpit domain control are quite similar, namely, “SoC+MCU” scheme. At present, the mainstream L2+/L3 domain control scheme is 1 or 2 SoCs + 1 MCU, in which the MCU acts as a security chip mainly responsible for target-level sensor fusion and decision tasks that require very high real-time performance.

Ecotron: launched the first-generation ADAS domain controller EAXVA03 in 2019. EAXVA03 uses NVIDIA Xavier SoC and Infineon TC297 MCU. Wherein, as a safety chip, TC297 meet the needs of control application scenarios that require ISO26262 functional safety level (ASIL-C/D), including safety monitoring, redundant control, gateway communication and vehicle control.

The domain controller has now evolved to the third version, EAXVA05, with 2 Xavier and 1 TC297, providing greater computing power.

Nissan: the first-generation ADAS domain controllers used master-slave MCU architecture in which Renesas R5F72531KFPU is the master MCU and Renesas R5F35L8KFF is the slave MCU. The second-generation ADAS domain controllers evolved into SoC+MCU architecture, with Renesas R-Car SoC as the master chip and Renesas RH850 MCU as the slave chip. RH850 is used to receive the result data and send the control commands such as steering wheel control, acceleration and braking to the relevant ECU.

(2) Integration of MCU into SoC

System-on-Chip (SoC) integrates CPU, GPU, DSP, ISP, and AI engine. In the future, SoC will integrate some low-end functions of MCU to simplify system design. Additionally MCU can also serve as an alternative to SoC for safety redundancy. MCU is removed from the dual domain control in Tesla’s FSD HW3.0.

Some vendors have started to integrate MCUs into SoCs to replace external MCUs. For example, TI’s TDA4VM integrates real-time MCU, functional safety MCU, C7x DSP, MMA deep learning accelerator, VPAC DMPAC vision accelerator, internal ISP and Ethernet switch into a SoC, simplifying ADAS system hardware.