High-precision Positioning Research: from L2+ to L3, high-precision integrated navigation and positioning will become the standard

With the development and progress of the autonomous driving industry, 5G communication and Beidou navigation applications are becoming more and more mature, and the high-precision positioning market has seen development opportunities. From 2022 to 2025, autonomous driving will gradually evolve from L2/L2+ to L3/L3+. High-level autonomous driving has higher requirements for positioning accuracy which should reach the centimeter level. This promotes the further development of high-precision integrated positioning technology.

L3 autonomous driving is heading for mass production, and integrated navigation positioning becomes the standard

In March 2021, Honda officially released the L3 autonomous production car, Honda Legend EX (which obtained L3 autonomous driving certification from the Ministry of Land, Infrastructure, Transport and Tourism of Japan) equipped with the Honda SENSING Elite intelligent driving system, high-precision positioning modules, sensors and a 3D HD map.

Honda has produced 100 units of L3 autonomous models, which are leased and sold to users in Japan for three years, allowing users to drive on designated roads in Tokyo.

In December 2021, the German Federal Motor Transport Authority (KBA) granted system approval for Mercedes-Benz’s L3 autonomous driving system on the basis of the technical approval regulation UN-R157 (UN Regulation No. 157 – Automated Lane Keeping Systems (ALKS)), allowing the sale and driving of L3 autonomous vehicles from a legal level. This is a breakthrough in mass-produced autonomous driving technology.

According to Mercedes-Benz’s plan, its two flagship sedans, S-Class and EQS, will be equipped with the L3 autonomous driving system (including a high-precision positioning module + HD map) at first. It is expected that consumers will be able to purchase L3 Mercedes-Benz cars in the first half of 2022. The contracting states of UN-R157 include EU countries, the United Kingdom, Japan, South Korea, Australia, etc., which means that Mercedes-Benz’s L3 autonomous vehicles can be sold in these countries.

China has not legally allowed L3 autonomous vehicles to be on the road, but L2+ (close to L3) autonomous models have been launched intensively so far. According to the statistics of ResearchInChina, the assembly rate of L2 autonomous passenger vehicles exceeded 20% in China in 2021. Some of the L2 models have achieved high-speed pilot autonomous driving by installing high-precision positioning and HD maps. For example, Xpeng P7, NIO EC6, ES6, ES8, GAC Aion V, Aion LX, Great Wall WEY Mocha and other models can be equipped with optional high-precision positioning modules. FAW Hongqi E-HS9, HiPhi X, 2021 Li ONE and other models are equipped with high-precision positioning modules as standard.

In addition to the existing mass-produced models, OEMs have successively launched more than 10 models equipped with high-precision positioning technology since 2021, such as Xpeng P5, NIO ET7, Neta U Pro, Aion V Plus, Aion LX Plus, Great Wall Mecha Dragon, BAIC ARCFOX αS Hi, etc.

Currently, a single positioning technology cannot meet the high precision required for autonomous vehicles. The solutions used by OEMs basically use multi-sensor integrated positioning technology. In addition to integrated navigation modules and HD maps, technologies such as visual SLAM and Lidar are also used.

Relative positioning cannot be used with standard HD maps, because their coordinate systems, data formats, interfaces, and timelines are completely different. Standard HD maps must be used with absolute positioning. Therefore, the current mainstream positioning technology is that GNSS, IMU, and HD maps cooperate and complement each other to form a high-precision positioning system for autonomous driving.

Baidu: It has been laid out for many years in integrated positioning technology, and can provide self-positioning system and centimeter-level integrated positioning solutions based on GPS, IMU, HD maps and data from multiple sensors.

Baidu Apollo’s research and test results show that GNSS-RTK can cover 65% of integrated scenarios with the error of less than 20cm, the combination of GNSS+IMU can cover about 85% of the scenarios, and the high-precision positioning system consisting of GNSS+IMU, sensors and maps can achieve 97.5% coverage.

The integration trend of high-precision positioning technology is obvious

(1) Independent positioning box

In terms of product form, the current automotive integrated navigation system with high-precision positioning mainly exists in the form of a positioning terminal, that is, a positioning box (P-Box).

As a small ECU responsible for high-precision positioning, P-Box can provide positioning data to the map module to realize the matching of positioning technology and HD maps.

With the advancement of technology, in addition to integrating GNSS and IMU, P-Box will further integrate HD maps. By HD maps and high-precision positioning, more accurate positioning data can be obtained.

Asensing: In April 2021, an HD map box was launched, which integrates IMU, RTK, vehicle speed, ADAS cameras and HD map data. Based on the fusion of MEMS high-precision inertial navigation data and high-precision satellite positioning data, the HD map box adds perception data of ADAS cameras and HD maps to make the lateral error less than 0.2 meters and the longitudinal error less than 2 meters at 95% confidence interval.

(2) Integration with wireless communication modules

The integration of automotive wireless communication modules and GNSS high-precision positioning is becoming a trend. For example, the Hongqi E-HS9 launched at the end of 2020 is equipped with a C-V2X smart antenna developed with Neusoft jointly and integrated with a GNSS receiver; Buick GL8 Avenir, launched at the end of 2020, is equipped with Quectel’s AG15 and AG35 modules and GNSS technology.

Joynext: On the basis of the traditional T-Box module, it integrates V2X, Bluetooth key, high-precision positioning and HD map output, providing sub-meter high-precision positioning. Joynext has signed a contract with NIO’s 5G-V2X platform project to provide the latter with 5G-TBOX and 5G-VBOX, which will be applied on ET7 at first.

Quectel: It has cooperated with Qualcomm and Qianxun SI to launch a variety of automotive communication modules that support high-precision positioning based on Qualcomm’s 3D dead reckoning technology and built-in Qianxun SI’s high-precision positioning service. For example, AG55xQ series, the 5G&C-V2X automotive module with built-in multi-constellation GNSS (GPS/GLONASS/BeiDou/Galileo/QZSS) receiver, can support dual-frequency GNSS, high-precision RTK/PPE and GNSS/QDR integrated navigation solutions according to application requirements.

(3) Integration with Autonomous Driving Domain Controllers

Integrating the high-precision positioning module into the autonomous driving domain controller can reduce data transmission, effectively shorten information delay, and improve positioning accuracy. At present, automakers have begun to disassemble integrated navigation boxes and integrate GNSS modules and IMU modules into their own domain controllers.

At present, passenger cars basically use sub-meter-level integrated positioning modules, which have a low level of functional safety and are not necessary to integrate into domain controllers. When autonomous driving evolves to L3+, L4/L5, high-precision integrated positioning modules must reach the centimeter level, and meet higher functional safety requirements, so that they can be integrated into autonomous driving domain controllers. By then, the value of the integrated navigation and positioning module of each vehicle will be higher, which will also be the priority of major OEMs and suppliers in the next stage.

With the maturity of domain controller technology and the evolution of electronic and electrical architecture, the integration of high-precision positioning units and high-level autonomous driving domain controllers may become one of the mainstream solutions.

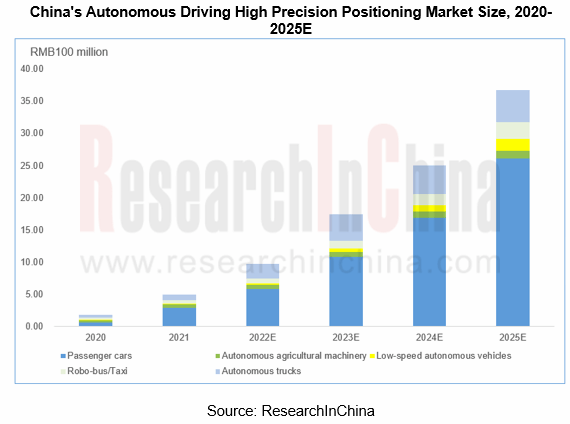

The prospect of high-precision positioning market is promising

According to Intelligent Connected Vehicle Technology Roadmap 2.0 released in November 2020, the penetration rate of L2-L3 ICVs will reach 50% by 2025, and L4 ICVs will begin to enter the market and be available in certain scenarios and limited areas for commercial applications; by 2030, the penetration rate of L2-L3 ICVs will reach 70%, and L4 ICVs will be widely seen on expressways and some urban roads.

Supported by policies, the assembly rate of L2 autonomous vehicles will continue to grow, and the assembly rate of sub-meter-level integrated positioning modules will keep rising; L3 and L4 autonomous vehicles will gradually spread to the market, and the shipments of centimeter-level integrated positioning modules with higher value will swell. Therefore, it can be predicted that the market space for high-precision positioning in the next few years is very broad.

With the increase in the assembly rate of L2+ and L3 autonomous driving functions, the high-precision positioning market has a promising prospect, and the industry will be recognized by investors.

In October 2021, Asensing raised hundreds of millions of RMB in Series C financing led by Sequoia China and joined by Matrix Partners, GL Ventures and other institutions. The funds will be spent on the research and development of the next-generation functional safety high-precision positioning technology, product design improvement and capacity construction.

In October 2021, DAISCH completed the Pre-A round of financing, which was involved with Aosheng Capital. The raised funds will be invested in developing new products and processes, and improving delivery capabilities.