With the combination of BLE, NFC and UWB, the digital key will present five major development trends

Through communication technologies such as BLE (Bluetooth), NFC, UWB, etc., the digital key turns smart terminal devices such as smartphones, NFC smart cards, smart watches and smart bracelets into vehicle keys, so as to realize keyless entry and start, and remote key authorization and personalized vehicle settings, as well as offer safer key management, comfortable and convenient experience. It will be integrated into smart mobility ecosystem in the future.

Trend 1: From 2022 to 2025, the digital key market will maintain rapid growth

ResearchInChina’s data shows that more than 2 million Chinese passenger cars were equipped with digital keys in 2021, a year-on-year spike of 243%; the assembly rate hit 10.9%, an increase of 7.5 percentage points from the previous year. Affected by the tight supply of chips, the assembly volume of automotive digital keys in 2021 was lower than expected. In the future, as the supply of chips stabilizes, the assembly volume of digital keys will rise rapidly. By 2025, 7.84 million cars will feature digital keys, with an average growth of 38%; the assembly rate will reach 30%, with AAGR of 5 percentage points.

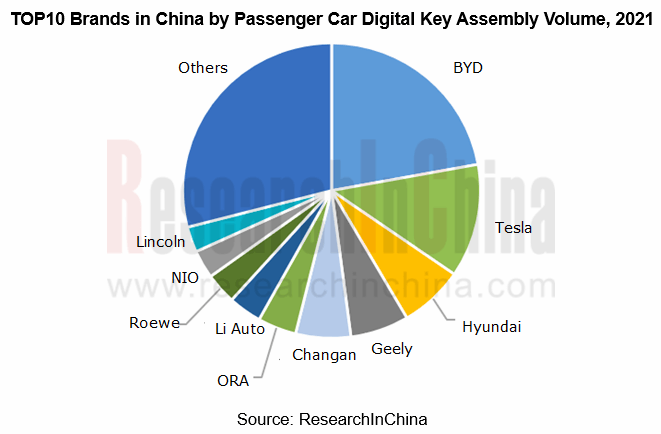

In terms of assembly volume, BYD sees the highest assembly volume of digital keys for passenger cars in China, followed by Tesla; they enjoy a combined market share of 34.6%. From the perspective of assembly rate, Tesla, Voyah, HiPhi, NIO and other emerging brands have achieved 100% assembly rate.

Trend 2: Bluetooth will still be the mainstream solution for digital keys in the future

In 2021, Bluetooth keys accounted for 64.2% of China’s digital key mass production solutions as the most important solution. In addition, integrated solutions of Bluetooth + NFC or Bluetooth + password keys are gradually being applied by automakers. At this stage, whether it is a separate module or an integrated solution, Bluetooth acts as the most mainstream digital key communication technology.

The main advantages of Bluetooth include:

①It is enough to develop only one application platform as per the Global standards;

②All Bluetooth functions can be connected to a main control device of a car, reducing complexity and cost;

③Bluetooth supports two-way communication, eliminating the need for special tools and reducing development complexity and cost;

④Bluetooth features higher security than the existing RF solution;

⑤It is easy to connect devices such as smartphones directly to cars.

In the future, Bluetooth will play an increasingly bigger role in digital keys, autonomous driving and smart cockpits, and will continue to occupy a dominant position in digital key solutions.

Trend 3: UWB solutions start to be available in cars

In 2022, the market will see the mass production and assembly of UWB keys. BMW will introduce the BMW Digital Key Plus based on the ultra-wideband (UWB) technology promoted by Apple to its 2022 models. NIO will install UWB digital keys for ET7 and ET5 to be delivered in 2022 for centimeter-level high-precision positioning. In addition, Samsung is also cooperating with automakers such as BMW, Audi, Hyundai, and Ford in UWB technology.

UWB boasts advantages like high positioning accuracy, high transmission rate, high security, and low power consumption. It can meet the wireless connection requirements of users in different scenarios. Especially in terms of security, UWB technology can better prevent relay attacks and prevent radio signals from being intercepted or interfered.

Thanks to high-precision positioning, UWB will be used in vehicles more often.

①Vehicle anti-theft, automatic trailer hitch, in-vehicle occupant monitoring, etc. (developed by Volkswagen & NXP)

②Anti-theft, keyless entry, remote parking, autonomous driving, micro-navigation, AR-HUD, proximity sensing, vehicle interior detection, rain sensing, etc. (developed by Continental Group)

③Tailgate kick, liveness detection (developed by TSINGOAL)

Trend 4: The collaborative solution of NFC+BLE+UWB is expected to become the mainstream

The combination of NFC, BLE (Bluetooth) and UWB is the best solution for digital keys at this stage. Whether it is long-distance, short-distance, or the network environment is weak or the mobile phone is turned off, vehicles can be unlocked smoothly. Specifically, Bluetooth is used to wake up UWB and encrypt data transmission; UWB is used for precise positioning, and NFC enables access when the phone is out of power. At present, foreign suppliers represented by NXP and domestic solution suppliers like INGEEK are all developing this solution.

NXP

Based on core technologies such as NXP automotive UWB IC NCJ29D5 (B/D), automotive Bluetooth SOC KW38, and automotive MCU S32K144, the fusion solution can unlock and start vehicles through NFC-enabled smartphones, remote keys, or NFC smart cards with digital keys.

INGEEK

As the mainstream digital key product solution provider, INGEEK released the next-generation smart digital key in October 2021, which adopts BLE, NFC, UWB and other technologies to unlock vehicles with smartphones or watches and completely replaces physical keys. The system fully connects intelligent cockpit, telematics and Internet social platform to realize complete personalized user experience.

Trend 5: Digital keys will carry more functions aid the trend of smart mobility

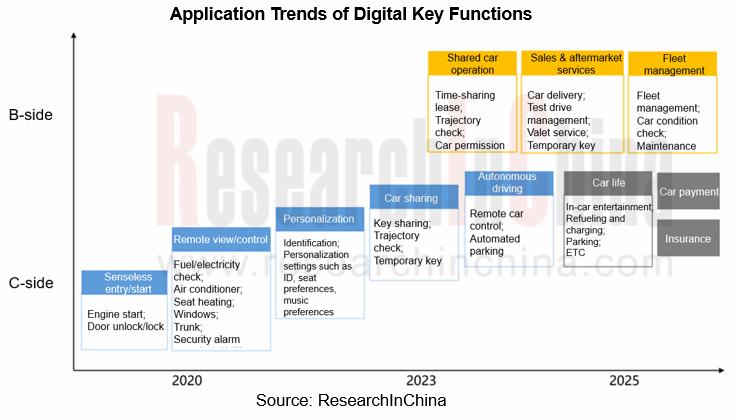

In addition to sensorless entry/start, remote viewing/control, digital keys have more potentials in functions and scenarios.

In the short term, C-side functions in scenarios (such as personalized settings, vehicle sharing, and autonomous driving) and B-side functions (like shared car operation, sales & after-market services, and fleet management) will be the focus that can be tapped. In the long run, digital keys will connect with more ecosystems and carry more functions amid the trend of smart mobility.