According to Brandessence Market Research, the Advanced Driver Assistance Systems Market size reached USD 18.77 Billion in 2021. The ADAS Market is likely to grow at robust CAGR of 15.2%, and reach size of USD 50.55 Billion by 2028 end. Increasing the demand for safety vehicles coupled with fuel efficiency expected to grow the Global ADAS Market.

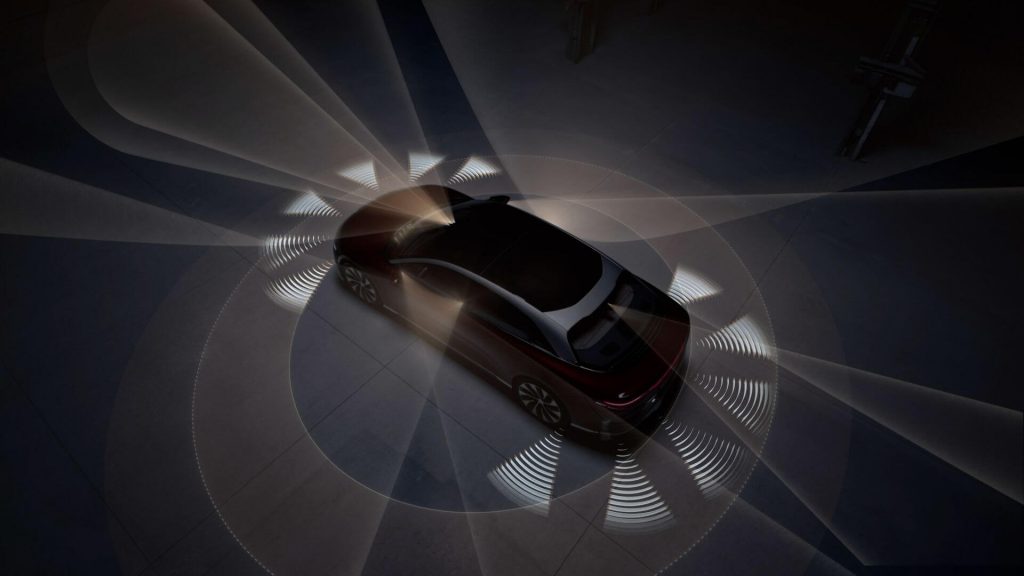

Advanced Driver Assistance System (ADAS) is referred as vehicle-based intelligent safety systems which help to improve road safety in order to avoid crash, accidents severity and post-crash phases. ADAS is equipped with various components including road safety warning system that provides audio and visual alerts. Since in 1990, GPS navigation has become very common in OEM infotainment systems since first being introduced. ADAS is usually found with vision based, radio detection and ranging (RADAR), and other advanced-sensing technologies. ADAS systems not only improve safety but also help to reduce hard braking, optimize engine performance and give drivers better fuel efficiency. ADAS can easily detect a wrong lane change and sends an alert through display Panel to get back in correct lane as well as enable to change the driving style of the vehicle and saving fuel consumption by 15%.

Key Companies Covered in Advanced Driver Assistance Systems Market

The ADAS market remains a fragmented and innovative landscape, with increased third-party ADAS making their way into consumer hands. The growing demand for effective systems, and wide-disparity between consumer preferences remain notable drivers of growth for players in the ADAS market. The wide-disparity continues to put power into the hands of OEMs, and wealthy individuals to dictate the future growth of ADAS market, while third-party apps continue to lead innovation with tremendously promising feature-rich products. With limited promising innovation, and large purchasing power, key players in the ADAS market continue to rely on mergers, and acquisitions to advance market share. Some key players in the ADAS market are

- Bosch

- Delphi

- TRW Automotive

- BMW

- Mobileye

- Hitachi Automotive

- Valeo

- Continental AG (Germany)

- Hyundai Mobis (South Korea)

- Magna International (Canada)

- Robert Bosch (Germany)

- Aptiv (UK)

- Denso (Japan)

- Valeo (France)

- ZF Friedrichshafen (Germany)

- Veoneer (Sweden).

Advanced Driver Assistance Systems Market Segmentation on the basis of type, end-user and region & country level.

By Component Type

- System Type

- Tire Pressure Monitoring System

- Drowsiness Monitor System

- Intelligent Parking Assist System

- Adaptive Cruise Control System

- Blind Spot Object Detection System

- Lane Departure Warning System

- Adaptive Front-lighting System

- Others (Night Vision System and Driver Monitoring System)

- Sensor Type

- Image Sensor

- LiDAR Sensor

- Ultrasonic Sensor

- Infrared Sensor

- RADAR

- LASER

By Vehicle Type

- Passenger cars

- Commercial vehicles

ADAS Market: An Overview

Research by National Highway Traffic Safety Administration in the US showed that manual errors are responsible for over 94% of the accidents. While multiple factors contribute to these crashes, the failure to recognize hazards remains key reason for most fatalities. The ADAS systems are capable of recognizing and responding to hazardous conditions better than a human driver. Moreover, these systems are already installed in police vehicles to help them gauge speeds from other drivers, recognize hazardous road conditions, and respond to threats. Such systems have proven their efficacy, with a long history in countries like the US. Moreover, the growing demand to respond to key needs like emergency breaking, engage in ideal driving experiences with adaptive cruise control, and much required assistance for the disabled, and elderly like park assist remain some key features to promise growth in the ADAS market.

The Advanced Driver Assisted Systems are aimed at providing a wide range of features including navigation, safety, comfort, entertainment, autonomous breaking systems in emergencies, adaptive cruise control, lane warning departure, park assist, among others. The support from regulators for many Advanced Driving Assisted Systems or ADAS remains strong. For example, in December, 2021, the European Union mandated the installation of automated emergency breaking systems in vehicles. According to the European Transport Safety Council, automatic breaking can reduce road fatalities by as much as 20%, resulting in over 4,000 lives saved each year. Moreover, in the US, such systems are also being installed in various advanced cars proactively, despite the installation being voluntary. The growing demand from consumers, the increased regulatory support, and increased progressive initiatives on the part of manufacturers remain key drivers to growth in the ADAS market.

ADAS systems have been around for a while. However, due to prospect of advanced electric vehicles, and their high-status among consumer, the ADAS system promise far more commercial opportunities in the near future. Moreover, ADAS systems have also proven them commercially viable in recent times. Apart from the regulations supporting their inclusion, research also continues to showcase their importance. For example, in 2021, AAA automotive researchers noted that the ADAS systems warned drivers about issues every 8 miles, on average. Hence, ADAS systems are ready to take control of important functions. Their future prospect largely depends on their ability to deliver an effective service. With the inclusion of technology, costs of sensor-based ADAS systems are likely to be high. Hence, it is important for companies to ensure an optimum level of experience for drivers, with effective results. Issues like ADAS focusing a little heavily on non-issues like lane centering continue to plague the current systems. Moreover, the ADAS also disengage without a notice, or fade away in the background, without a proper communication with the driver. Such challenges continue to pose restraint to growth of the ADAS market.

ADAS Market Key Regional Analysis

- UK ADAS market: Innovation continues to lead the way in countries like the UK, where Advanced Driver Assistance Systems are being integrated in aerial car technology. Airline Cars are making a promising entry into the UK region, which promise to replace short-haul flights. These airline cars are also being experimented with ADAS technology, promising to make them completely automated in the near future. Car Design Research, a UK-based agency estimates that these cars can make 50 short hauls with the same airline emissions as compared to 50 flights by a conventional airline.

- Europe ADAS market: In January, 2022, Luminar, a key player in hardware and software automation, and Volvo announced plans to launch a next-generation EV. The EV promises to integrate advanced ADAS features like completely automated driving on highways. The feature will be introduced in the state of California soon, as an add-on subscription. The technology remains a major leap for a key player in the European region in the advancement of ADAS technology.

- US ADAS market: In June, 2021, the US National Highway Traffic Safety Administration (NHTSA) mandated car companies testing ADAS technology, to report accidents. The new rules were put on hold to provide an experimental trial period for car testing companies. However, new rules will mandate that ADAS systems above level 2 will be required to report all accidents by the system, moving forward.

- Asia ADAS market: In October, 2021, Qualcomm entered into a definitive agreement to acquire Veoneer, a key provider of automated technology designed to deliver an open self-driving platform. The deal valued at USD 4.5 billion puts Qualcomm in charge of creating a robust RCS, and active safety business need for the automotive industry.

- Japan ADAS market: In October, 2021, Japanese transport ministry announced a decision to expand the scope of automatic breaking systems to include bicycles, starting in July 2024. The new ADAS technology continues to increase road safety for vehicles, and the transport ministry has mandated similar protection for bicycles, with the use of camera, and radars installed on new bicycles.

- China ADAS market: Innovation also remains key in China, wherein a key player in in the automotive industry, Baidu, has launched Apollo Air. The technology enables level 4 autonomous driving capabilities, with integration of both vehicle-to-everything technologies. The new ADAS system can rely on roadside sensing, and remains a promising sign of innovation in China.

ADAS Market: Covid-19 Impact

The auto industry has come to a halt, partially due to the supply disruptions caused by Covid-19, and partially due to the lowered demand due to uncertainty in vehicle purchases. Various governments around the world have signaled a policy shift encouraging future with electric vehicles, regulating emissions, and promoting driverless vehicles to ensure road safety. In key automotive markets like the US, vehicle accidents remain some of the leading cause of fatalities, with the young population remaining most vulnerable. Furthermore, automation in driving also promises a major boost to rich-featured vehicles which bring more prestige, more facilities like digital navigation, more entertainment, while simultaneously eliminating driver-associated costs for wealthy individuals. This promises a major growth for the Advanced Driver Assisted Systems. The supply disruptions caused by the covid-19, especially in areas like the supply of semiconductor promise to continue as key countries continue to focus inward, despite tremendous opportunities for growth abroad.

The ADAS market report is divided in key regions including North America, Europe, Asia Pacific, Latin America, Middle East & Africa. Among these, the North America region is expected to witness highest sales of ADAS. Despite the covid-19 pandemic, and the economic downturn, the consumers in the region remain optimistic about new vehicle purchases. This is partially due to vehicles being an incessant need, and the promise of tremendous fuel-savings through the purchase of electric vehicles. The growing demand for electric vehicles in Europe also remains a promising prospect. According to the international energy agency, Europe witnessed the highest total sales of electric vehicle in 2021, surpassing both key markets of China, and US, surprising most analysts. The clear regulatory environment and high awareness about environmental concerns remain key drivers of growth in the European region. The Asia Pacific region remains a promising prospect for low-cost innovation, mainly aimed at two-wheelers. While countries like China, continue to step miles ahead of most countries around the world, the Asia Pacific as a region remains largely dependent on burgeoning sales of two-wheelers to drive growth, with countries like Vietnam, Thailand, India, among others noting high sales, along with China.